Today, people pay for everything online instantly with their credit and debit cards. So why not home valuations? Now powered by Stripe, the most advanced payment tech in the industry, Clear Capital is enabling you to bill your borrower directly via email for appraisals and our other valuation products.

Digital, convenient, timely, secure — this is what the modern consumer expects from the buying experience, and home appraisals are not exempt. Clear Capital has implemented Stripe payment and billing services so your borrower can benefit from a modern lending experience.

The days of unsecured credit card authorization forms being emailed back and forth are over. No more mailing the customer an invoice and then waiting for payment by check, if it ever comes. Who enjoys playing phone tag, in the hopes that someone will actually pick up their phone or return a voicemail asking for credit card payment? The turn-around time for payment could be minutes, not days, speeding your way to a faster close. Even if the borrower doesn’t pay immediately, Stripe handles the follow up emails automatically on a pre-set time schedule.

Stripe is the industry leader in providing secure and automated customer billing. They have been audited by a PCI-certified auditor and are certified to PCI Service Provider Level 1. This is the most stringent level of certification available in the payments industry. To accomplish this, Stripe makes use of best-in-class security tools and practices to maintain a high level of security.

Companies such as Nextdoor, Ring, and Meetup rely on their API-powered system to bill customers for billions of dollars every day. Additionally, Stripe’s online payment system will be the backbone of all of Clear Capital’s credit and debit card payment receipts for optimal security and efficiency. Learn more about Stripe billing here.

Borrowers can be billed electronically via email for credit card payment for our entire line of valuation solutions: Conventional Appraisals, ClearVal™ Hybrid Appraisals, BPOs, Property Inspections, Collateral Desktop Analysis (CDA), and Value Reconciliations. So, whether you’re originating a new mortgage or offering a home equity line of credit, you’ll be able to take advantage of the security and efficiency of Stripe’s advanced technology.

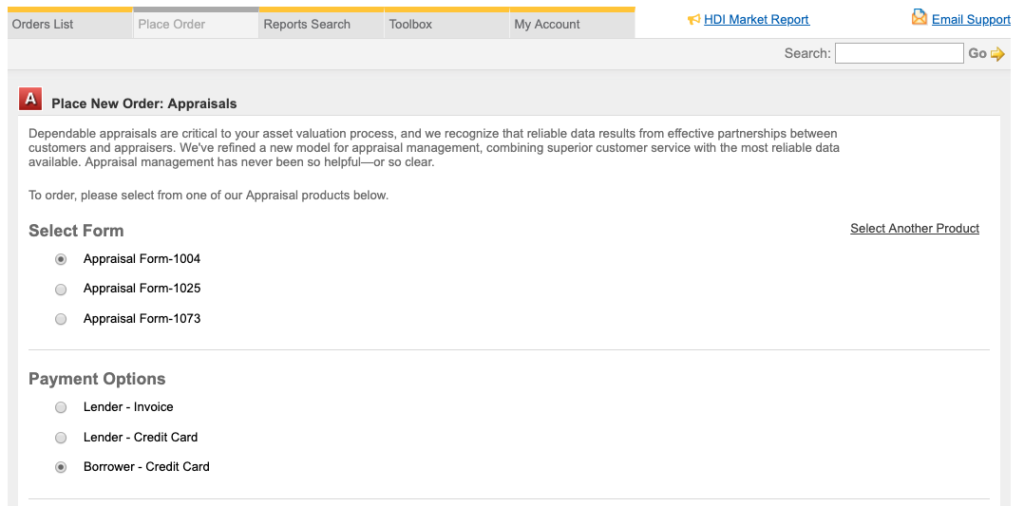

The feature is available in your customer dashboard today. All you have to do is select the “Borrower – Credit Card” option and place your order:

The order will be on hold until the customer pays the invoice. Hopefully we’ve made it so easy enough so you can start today. But if you have any questions or would like a demo, please reach out to us.