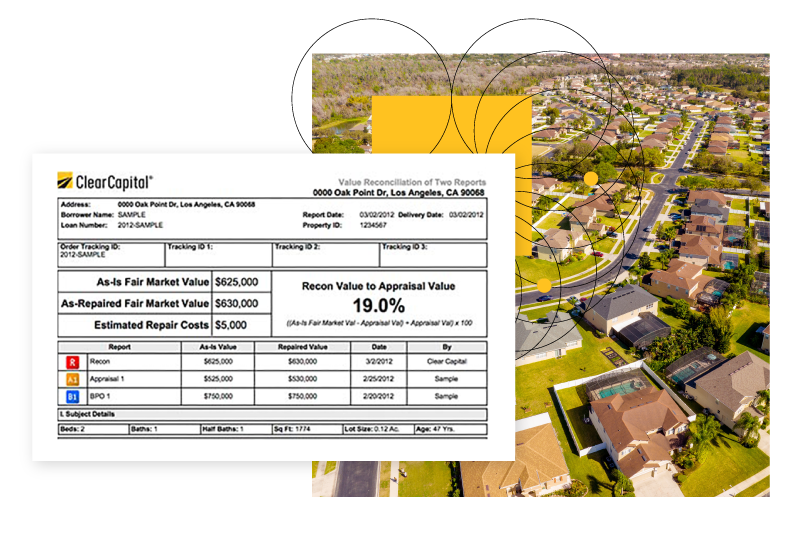

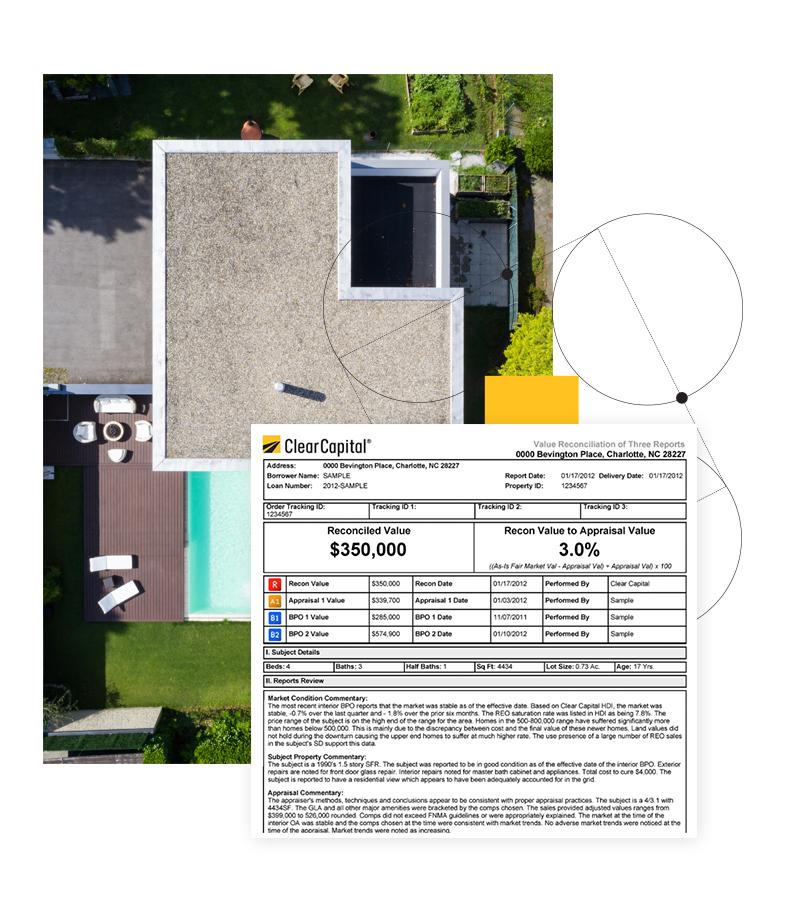

Get clarity and confidence around multiple value opinions with a single source of truth that provides a final ruling on a valuation.

Our experienced appraisers provide a clearly visible reconciled valuation conclusion and variance from the original report.

Get the clarity you need

Value reconciliations are one of the most vital steps in the investment process. Our Value Reconciliations are well-suited for times when specific loans within a pool are identified as risky and you need to make heads or tails of the conflicting market data.

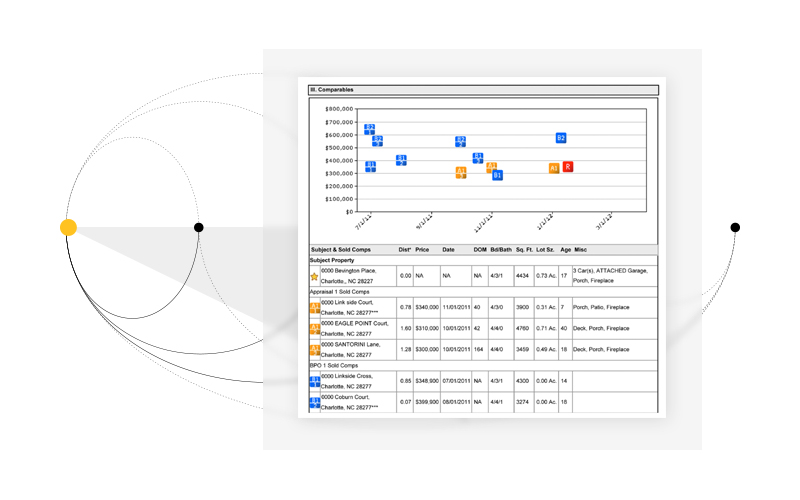

Clear Capital Value Reconciliations clearly state the reconciled values and are delivered with standardized, written appraiser narratives that are well-defined and well supported by empirical data. Our Value Reconciliations deliver:

Get uniformity, clarity, and confidence in the reconciliation process.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved