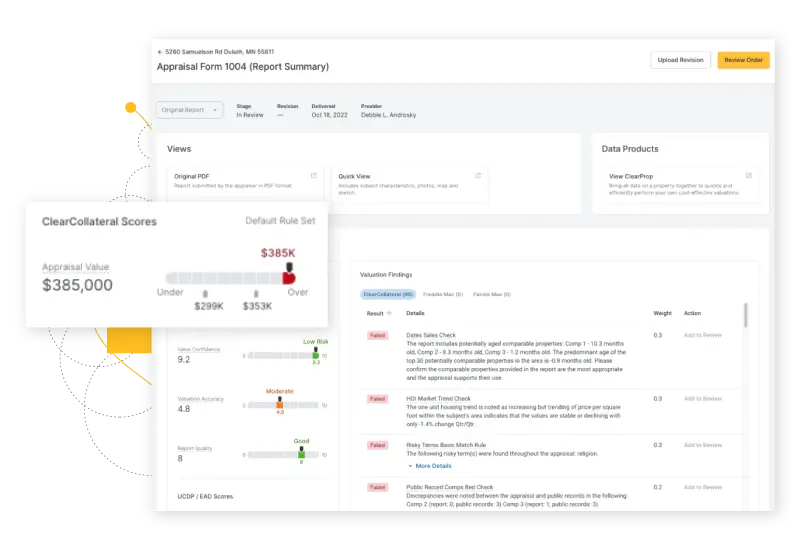

ClearCollateral Review automates workflows and provides powerful review tools fueled with robust data and analytics for the appraisal underwriting process.

ClearCollateral Review is available as a full web platform and can be integrated with your Order Management System or Loan Origination System with our API. Reviewers can easily access all the tools and data they need to review an appraisal in one place: loan characteristics, automated appraisal risk assessments, GSE findings, and external data.

ClearQC uses configurable algorithms to provide accuracy and adherence to specific underwriting guidelines and industry compliance in the loan decision process.

Fully customize when and how your rules are run by altering rule logic, tolerances, and severity.

Condition Model’s artificial intelligence quickly assesses the property condition using appraisal photos and property data, then compares it to the appraiser’s C-rating to flag any discrepancy.

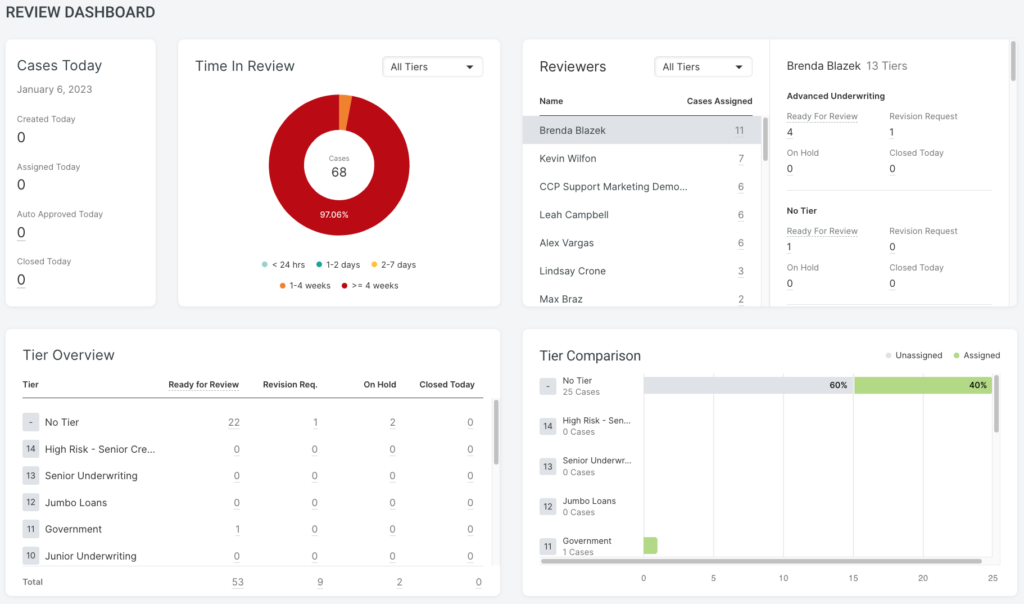

ClearCollateral Review allows you to scale your review needs to match the size of your portfolio. Assess the condition of multiple properties at once with ease.

ClearPhoto is a powerful set of AI-driven rules that automate the review of property photos and ensure they are aligned with the appraisal data and sketch.

ClearPhoto significantly reduces time spent identifying the photo-related error(s) by instantly checking for property photos’ accuracy and quality.

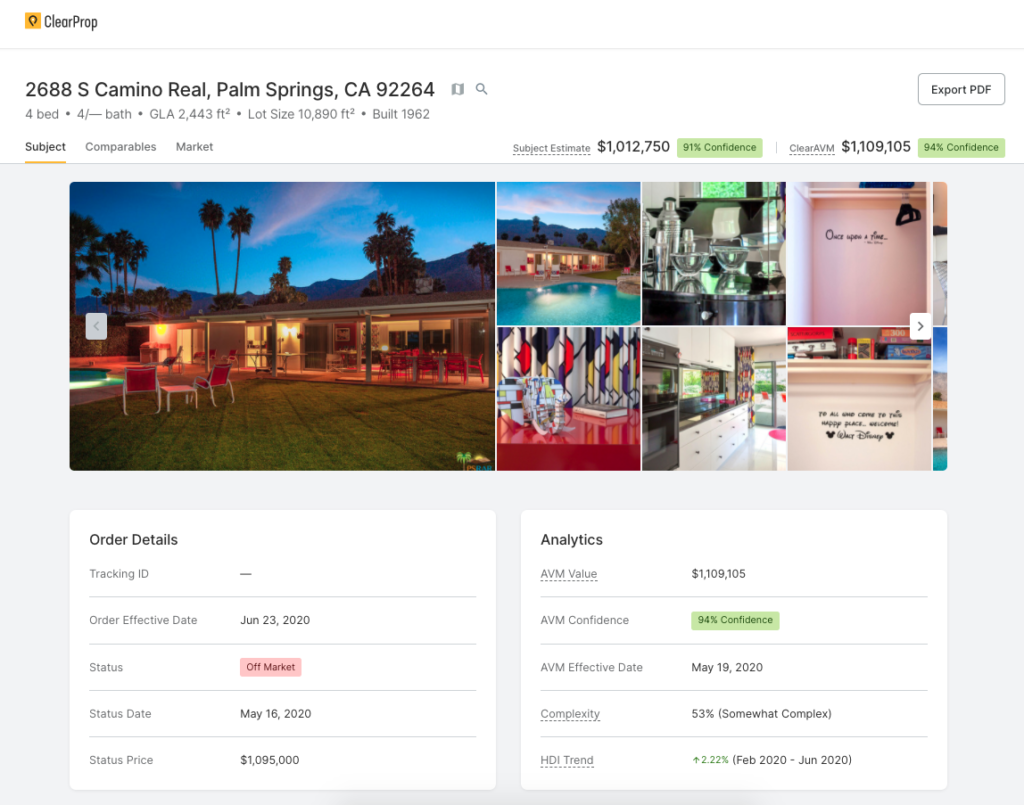

ClearProp unites data that is typically fragmented, making it a powerful research and verification tool. And while ClearProp is rich with data, it’s thoughtfully and meticulously organized.

View your subject and comparable properties, including map, satellite, and street imagery. Let us automatically select and rank comparables for you, or manually determine your own valuation.

Configurable review forms

Fully customizable review forms that range from simple checklists to complex deep dives. Leverage our autofill functionality to automate the majority of your review forms with objective information from the appraisal.

Valuation accuracy score

Understand the risk of over- or under-valuation by comparing it to ClearAVM™ — our lending-grade valuation engine.

GSE scoring

Automatic submission to the GSE and FHA portals allows you to review and configure your workflow around scores and findings as data — removing the need to manually download and review Submission Summary Reports (SSRs).

Risky terms rules

Detect bias within the appraisal with risky terms rules. Custom rules scan for problematic language used in the appraisal. Add additional rules to scan for any negative term you wish to flag.

Work within your system

Designed to integrate into existing order management systems, creating a clean workflow process.

Streamline your appraisal review and underwrite collateral more efficiently.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2025 ClearCapital.com, Inc. All Rights Reserved