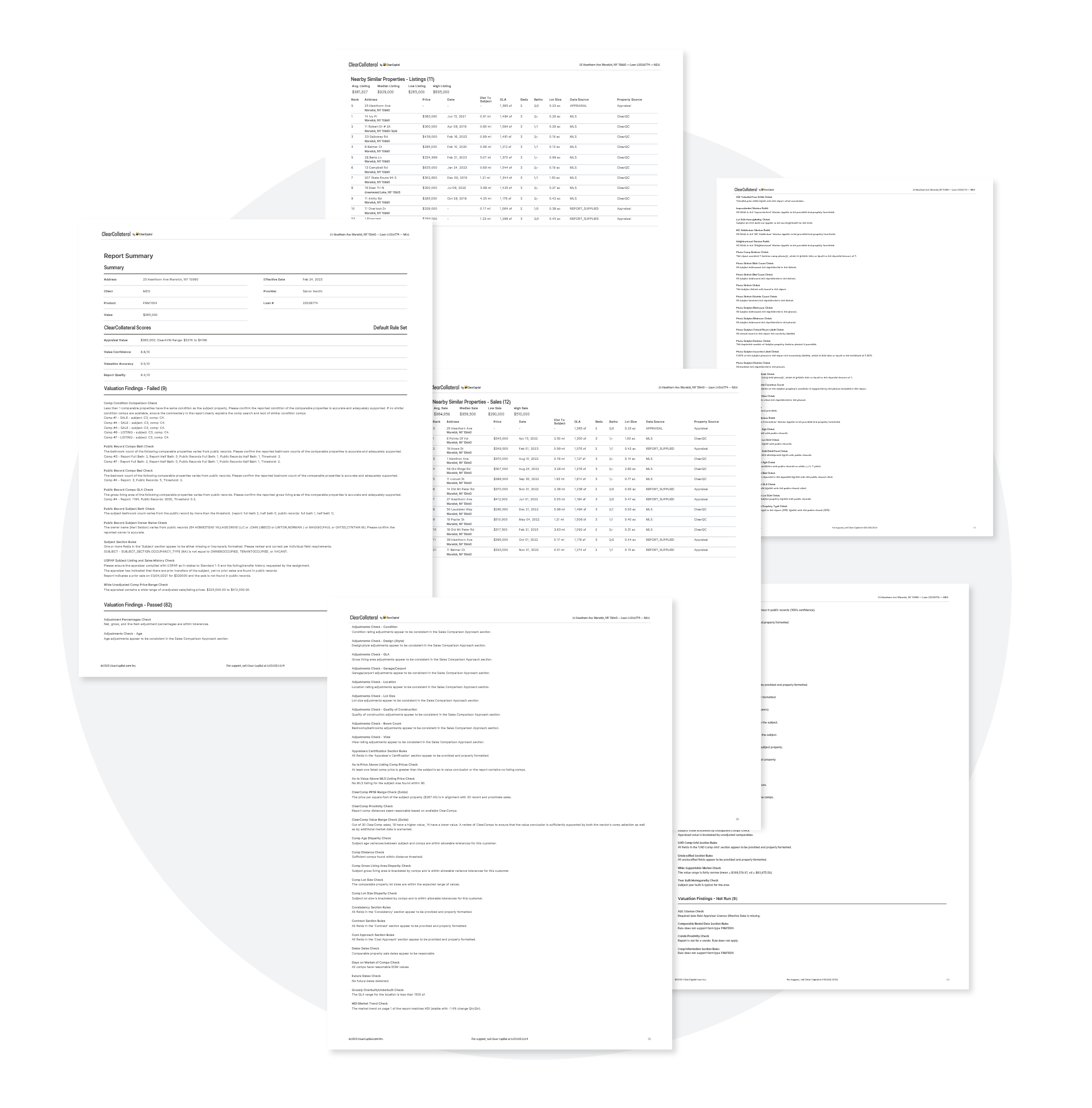

An intelligent automated collateral underwriting review tool. Close loans faster by applying a risk-based approach to appraisal review and unlock fair and accurately valued appraisals.

Aggregate data

The AURA PDF gives lenders a centralized assessment of risk in a cost- and time-efficient manner.

The AURA PDF includes results from public records, local market insights, ClearCollateral® risk scores, ClearQC rules, and ClearRank comparables.

Fully analyze an appraisal without performing manual review or searching elsewhere. AURA supports automated collateral review on PDF-only Uniform Residential Appraisal Reports.

ClearQC®

Highlights concerns within a valuation to direct the reviewers’ efforts and shave time off the process. ClearQC runs 100 rules on each appraisal to review the completeness and consistency of the appraisal, errors with the photos and sketch, the condition of a property, and more.

ClearPhoto®

A powerful set of AI-driven rules that automates the review of property photos and

confirms they are aligned with the appraisal data and sketch. ClearPhoto significantly reduces time spent identifying the photo-related error(s) by instantly checking for property photos’ accuracy and quality.

Condition Model

AI assesses a property’s condition using appraisal photos and property data, then compares the condition to the appraiser’s C-rating to flag discrepancies.

Risky Terms

Detect bias within the appraisal with risky terms rules that scan for problematic language that violates guidelines. Customize to scan for any negative terms.

ClearCollateral® Scores

Our Valuation Accuracy Score, Valuation Confidence Score, and Report Quality Score offer a holistic view of an appraisal’s accuracy and quality alongside our confidence in the valuation.

Comparables

Analyze the report-supplied comparables with Clear Capital’s ranked comparables using local market insights to understand the risk of over- or under-valuation via the sales comparison approach.

Reduce customer review efforts with automated underwriting. Keep your customers within your ecosystem and control the customer experience by building your own solutions using AURA data within your existing software. AURA is a 2024 HousingWire Tech100 Mortgage winner.

Our risk-based approach helps eliminate bias and ensures appraisals are properly valued while our data, review tools, and automation help you close loans faster.

View our API documentation to learn how to set up your developer account.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved