Access accurate valuations to understand collateral risks for mortgage insurance, and confidently understand property conditions for home insurance.

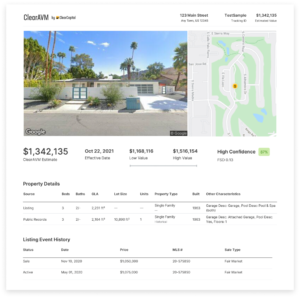

An automated valuation model with accuracy across 139+ million addresses nationwide.

Obtain AVMs for your entire portfolio or scan for ideal opportunities across the nation.

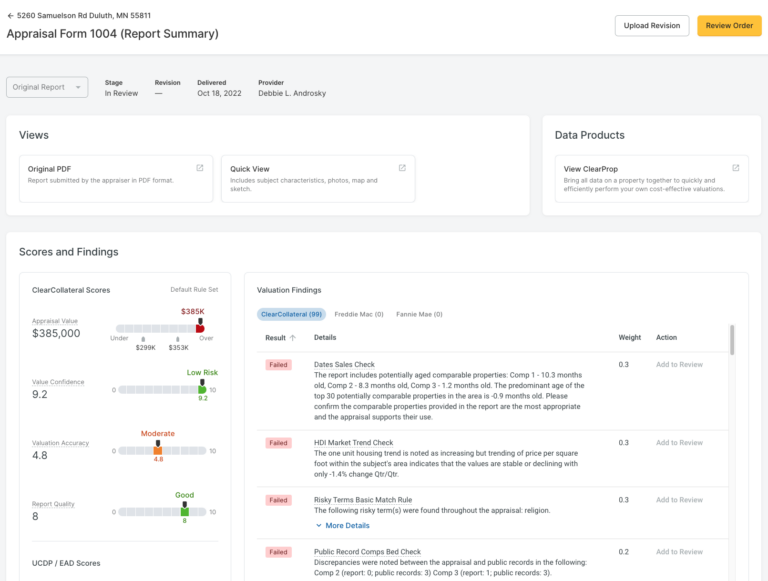

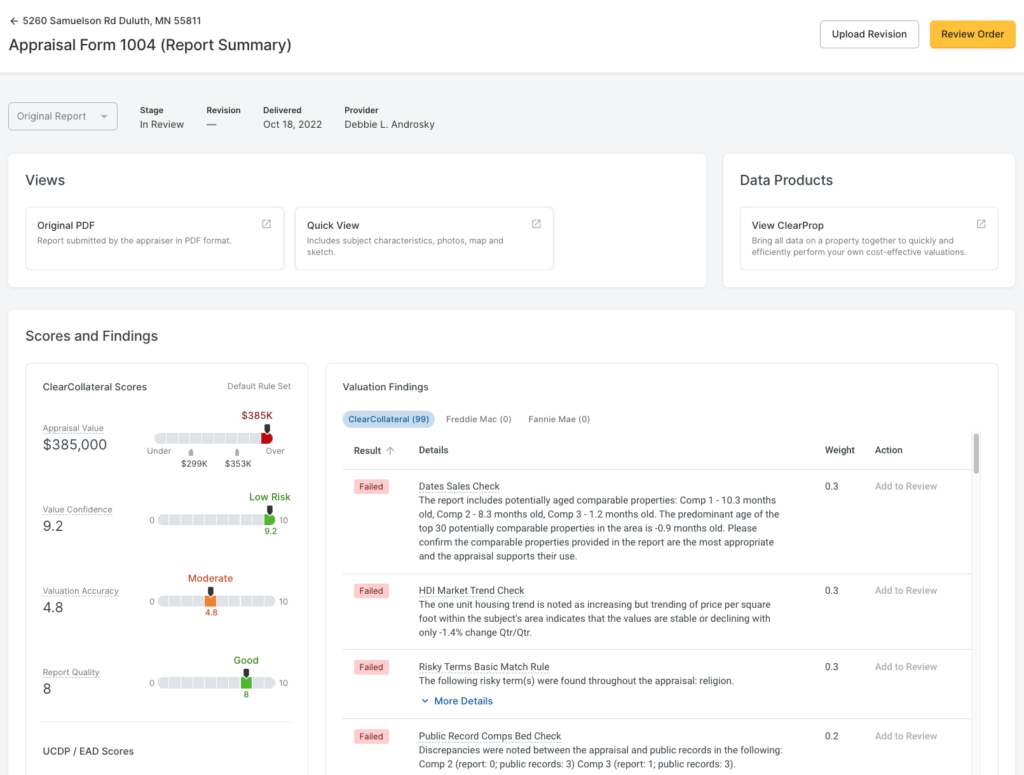

The industry’s leading dynamic appraisal review system. ClearCollateral Review uses loan characteristics, automated appraisal risk assessments, GSE findings, and external data.

ClearCollateral Review integrates with a full suite of customizable, artificial intelligence-driven solutions to perfectly fit your workflow.

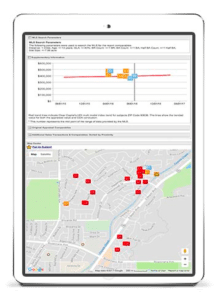

CDA is an efficient, cost-effective method to determine if the appraisal under review is adequately supported.

CDA offers comprehensive appraisal review and analysis for any period of time by a state-licensed appraiser.

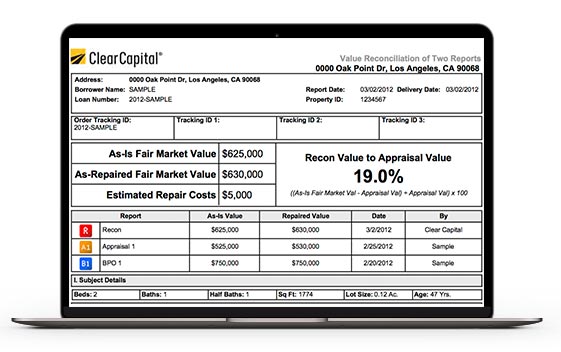

Get clarity and confidence around multiple value opinions with a single source of truth that provides a final ruling on a valuation.

Our Value Reconciliation is well-suited for times when specific loans within a pool are identified as risky and you need to make heads or tails of the conflicting market data.

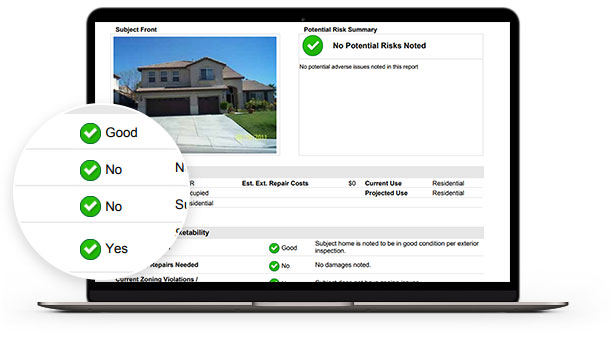

Local residential and commercial brokers collect property data to deliver a clear risk summary report that visually highlights factors that could influence a property’s marketability.

Our risk summary report visually highlights factors that could influence your property’s marketability, including eight key aspects of the property to help you spot red flags and risk factors.

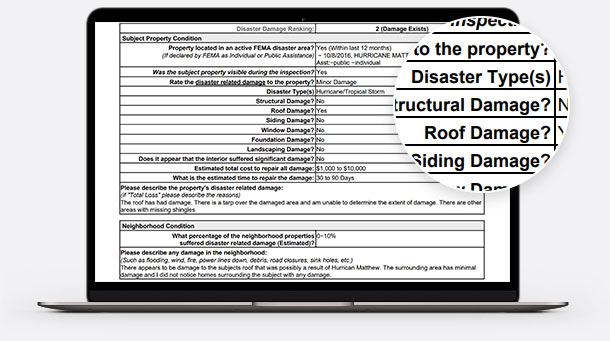

An experienced professional will validate and analyze pertinent details after floods, fires, hurricanes, tornadoes, and other disasters to reassure you on the current condition of a property.

Our network of licensed brokers and agents can be dispatched to the disaster site within hours to assess a property. Reports can be delivered in as little as two days.

The industry’s leading dynamic appraisal review system. ClearCollateral Review uses loan characteristics, automated appraisal risk assessments, GSE findings, and external data.

ClearCollateral Review integrates with a full suite of customizable, artificial intelligence-driven solutions to perfectly fit your workflow.

Understand property condition, access accurate home valuations, and find peace of mind on your mortgage or home insurance transactions.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved