Expand your portfolio, find new investment opportunities nationwide, and catch red flags in your current investments.

Identify investment opportunities, conduct due diligence on investments, and manage your portfolio with nationwide public records data through PropertyNova™. Clear Capital’s public records solution features one of the most comprehensive sets of records on the market and a dedicated support team to ensure you make the most of these powerful datasets.

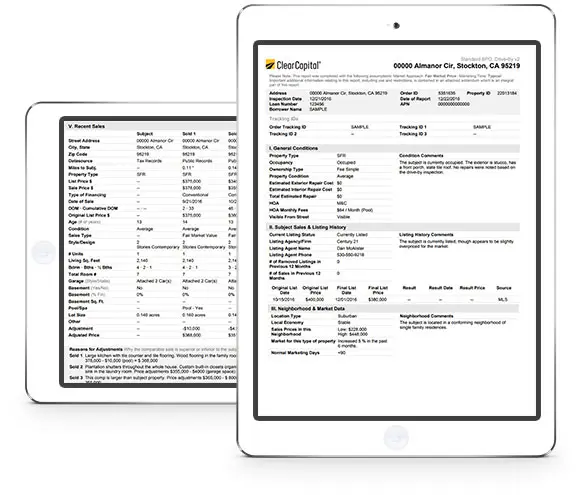

Remove pre-funding uncertainty. CDA is an efficient, cost-effective method to determine if the appraisal under review is adequately supported.

Clear Capital’s national-coverage ClearAVM provides reliable home valuations using the highest quality data and modeling power. ClearAVM predicts its expected

accuracy, delivering unparalleled valuation confidence.

Rental AVM provides reliable, automated estimates of monthly market rent for individual addresses using the same high quality data and modeling power of our lending-grade automated home valuation model, ClearAVM.

Get clarity and confidence around multiple value opinions with a single source of truth when specific loans within a pool are identified as risky and you need to make heads or tails of the conflicting market data.

Clear Capital’s HDI calculates home price trends from any effective date, providing you with more insight and clarity for each transaction. HDI provides additional, contextual data for an even sharper valuation picture.

Clear Capital’s Residential Broker Price Opinion (BPO) is the ultimate alternative to an appraisal for investments.

Commercial Broker Price Opinion (BPO) is a cost-effective alternative when you need a strong valuation analysis but not a full narrative appraisal.

Completed by a licensed appraiser from Clear Capital’s national appraisal management company (AMC).

Our Traditional Appraisal solutions fit a variety of lending needs, from conventional loans, refinances, home equity lending, and everything in between.

Certified property data, an ANSI-aligned gross living area (GLA), and 2D floor plan are collected and provided to a geo-competent appraiser to easily complete the 1004 Hybrid/70H appraisal.

Our program was co-developed with and designed for the major investors and top lenders. We’re actively expanding with additional investors.

Delivers a reliable opinion of value for single-family purchase loans using a 1004 Desktop/70D appraisal.

We pair innovative technology with our nationwide network of property data collectors and appraisers to deliver up to 50% faster than a traditional appraisal.

Find new investment opportunities and expand your portfolio.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2025 ClearCapital.com, Inc. All Rights Reserved