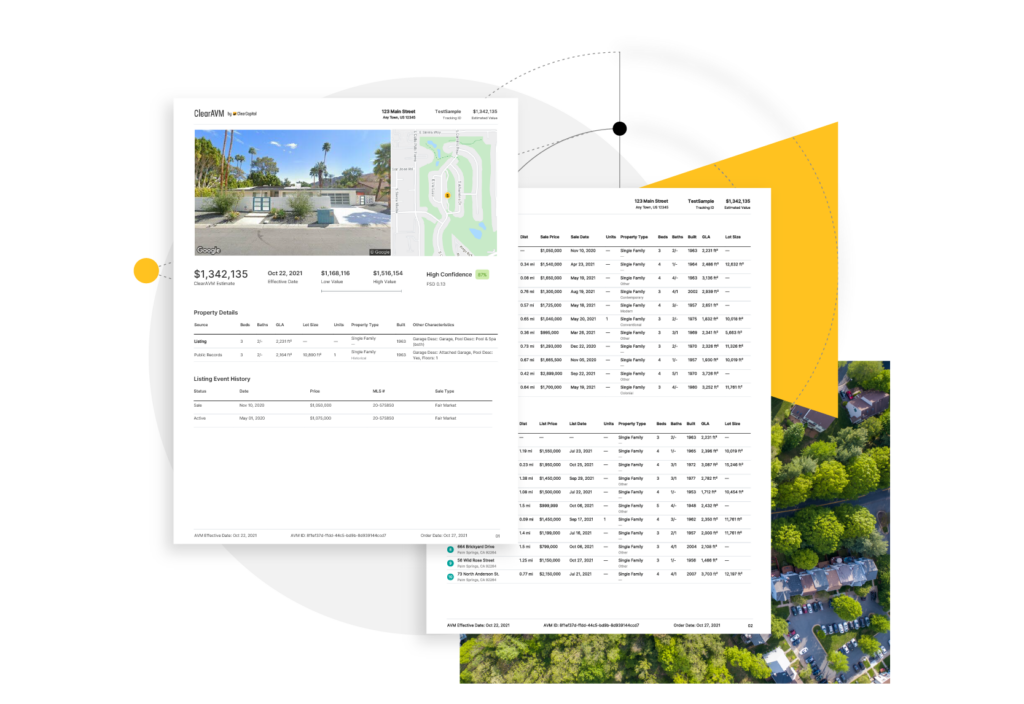

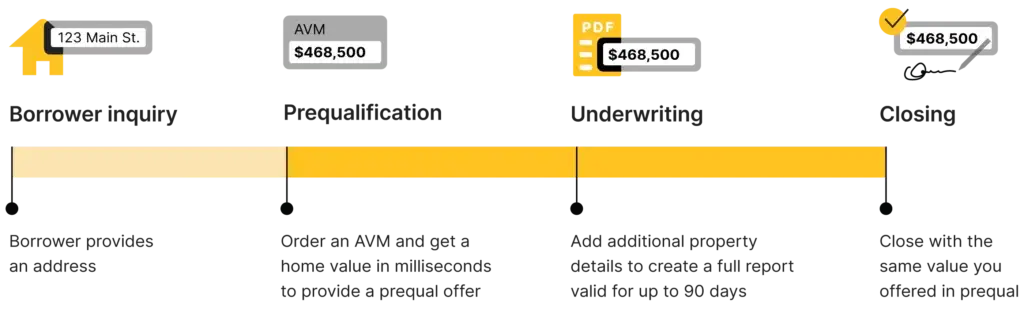

Get an automated valuation model (AVM) in prequalification and use it until closing. Add comparables or other property data once a file gets to underwriting — up to 90 days later.

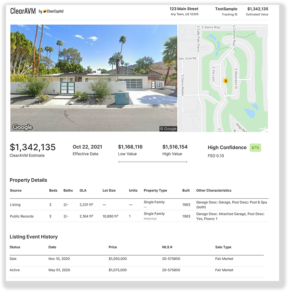

ClearAVM is tested against closed sale and refinance appraisal benchmarks, internally evaluated, and blind-tested. ClearAVM’s accuracy allows it to be relied on by investors and lenders.

Each ClearAVM includes a Confidence Score — the forecast standard deviation (FSD), which is rigorously tested to predict its accuracy and help you determine if a property requires further assessment.

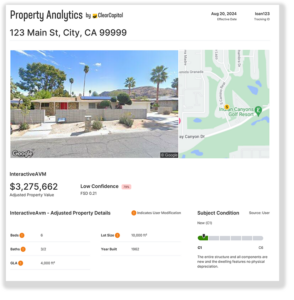

Interactive ClearAVM provides the ability to add a property’s condition as an input to the AVM and update information for the highest confidence in a valuation.

Include an inspector’s condition rating, spend less time reconciling a valuation, or perform scenario analysis to underwrite a property for its post-improvement value.

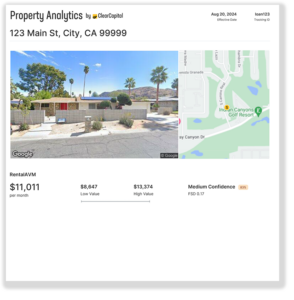

Fueled by the same highly accurate data that powers ClearAVM, Rental AVM considers sales transactions, closed rental values, and property characteristics to estimate monthly rental value.

Rental AVM features Confidence Score. Based on forecast standard deviation, Confidence Score determines each AVM’s predicted accuracy so users can determine if a property requires further assessment.

Add additional property information to the valuation to build a full understanding of the property or meet investor guidelines for underwriting:

Use any combination of these details to meet due diligence requirements without purchasing multiple products or duplicate data points.

Get started with Property Analytics API and access Clear Capital’s full suite of analytics solutions. Removes friction when adopting new products, integrate instantly, and immediately access the freshest property insights.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2025 ClearCapital.com, Inc. All Rights Reserved