Clear Capital supports the government-sponsored enterprises (GSEs) appraisal modernization programs such as Fannie Mae’s Value Acceptance + Property Data program and Freddie Mac’s ACE+ PDR solution.

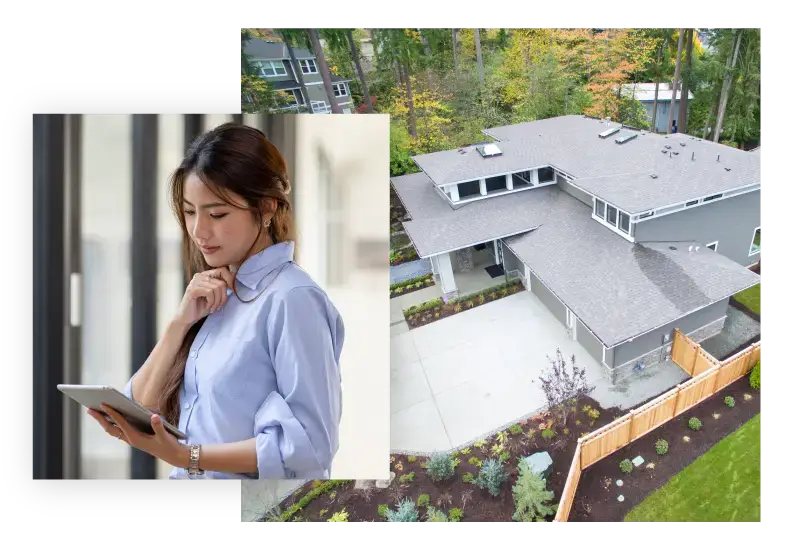

Because of Clear Capital’s vast experience in GSE appraisal modernization, our Universal Data Collection (UDC®) enables lenders to easily implement and scale inspection-based appraisal waiver programs nationally.

Universal Data Collection seamlessly integrates with our Hybrid Appraisal and Completion Report, providing lenders with a one-stop shop in case an upgrade is needed.

In the event that a loan receives eligibility for a GSE inspection-based appraisal waiver program, Universal Data Collection unlocks nationwide benefits.

Inspection-based appraisal waivers significantly increase underwriting efficiency and provide faster turn times than traditional appraisals

Pass cost savings onto borrowers — Universal Data Collection is less than half the cost compared to a traditional appraisal

Our data collection process is possible because of advanced technology, including digital GLA, data collector training, and extensive quality control

UDC delivers the Uniform Property Dataset (UPD), Fannie Mae and Freddie Mac's single data standard for property data collections

data collections by Clear Capital

trained real estate brokers/agents

coverage nationwide

Above all, UDC can support your appraisal workflows, reduce turn times, and save you money. Get started today with UDC today and become an early adopter of GSE inspection-based appraisal waiver programs.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2025 ClearCapital.com, Inc. All Rights Reserved