Clear Capital’s Residential Broker Price Opinion (BPO) is the ultimate alternative to an appraisal for servicing, origination, and investments.

BPOs verify and provide confidence on the value conclusion of the origination appraisal.

BPOs help update your collateral value. When loans default, a BPO can illuminate next steps.

A Clear Capital BPO will evaluate your investment’s risk while determining a price range on a loan.

BPOs help set an independent, reliable listing price on a real estate owned property.

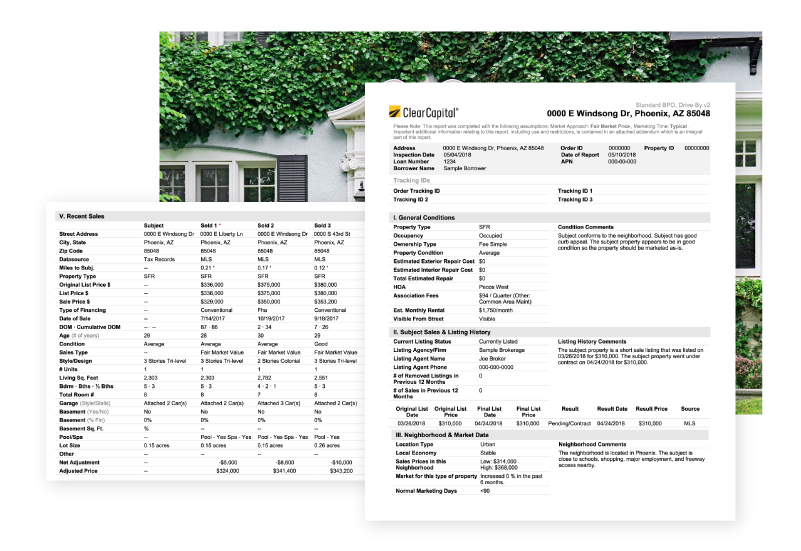

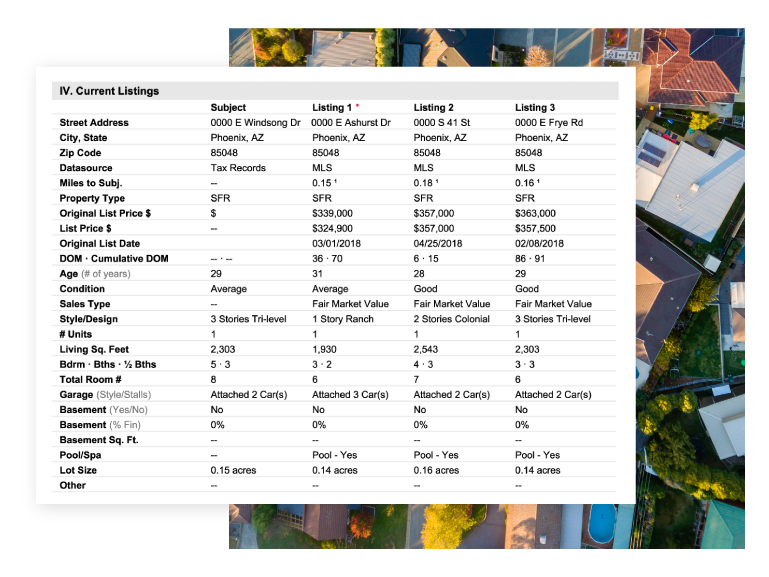

The data-rich BPO reports provide a clear understanding of the subject property for confident investment decisions. When you order a Clear Capital BPO, you’ll enjoy:

Add on a rental market report

Understand a property’s rental potential — access insightful and valuable rental information to get the full story on your investments.

The Rental Market Report can be added to a BPO. It allows you to better evaluate options and outcomes when determining investment strategies for distressed properties.

Get started with Clear Capital’s industry-leading Residential BPOs today.

Partner with Clear Capital and work with the nation’s top lenders, servicers, and investors. Fill out the short application to get started.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved