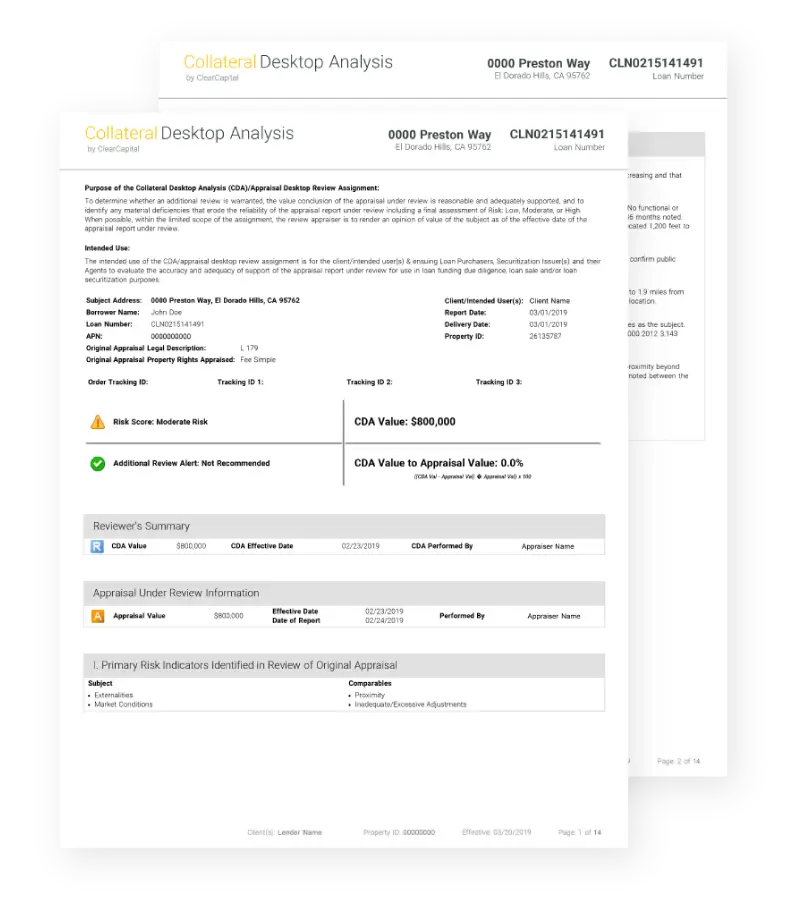

Designed to remove pre-funding uncertainty or support post-funding due diligence, CDA re-evaluates an appraisal so you can deliver a comprehensive, USPAP-compliant loan file quickly.

Access comprehensive appraisal review and analysis for any period of time by a state-licensed appraiser. CDA is an efficient, cost-effective method to determine if the appraisal under review is adequately supported.

Determine if a sample of appraisals warrant a more extensive review.

Data to support pre-fund due diligence before funding the loan.

Validate that provided comparables are representative of the subject and market.

Internal quality assurance audit in post-fund due diligence for lenders and investors.

Review to determine the reliability of the valuation and to understand if a repurchase is justified.

Remove pre-funding uncertainty. Let CDA re-evaluate your appraisals so you can deliver a comprehensive loan file quickly.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2025 ClearCapital.com, Inc. All Rights Reserved