The July 2022 Home Data Index™ (HDI™) Market Report shows national quarter-over-quarter (QoQ) home price growth is at 11.3 percent.

Download the report, or read it below.

Commentary by Brent Nyitray of The Daily Tearsheet

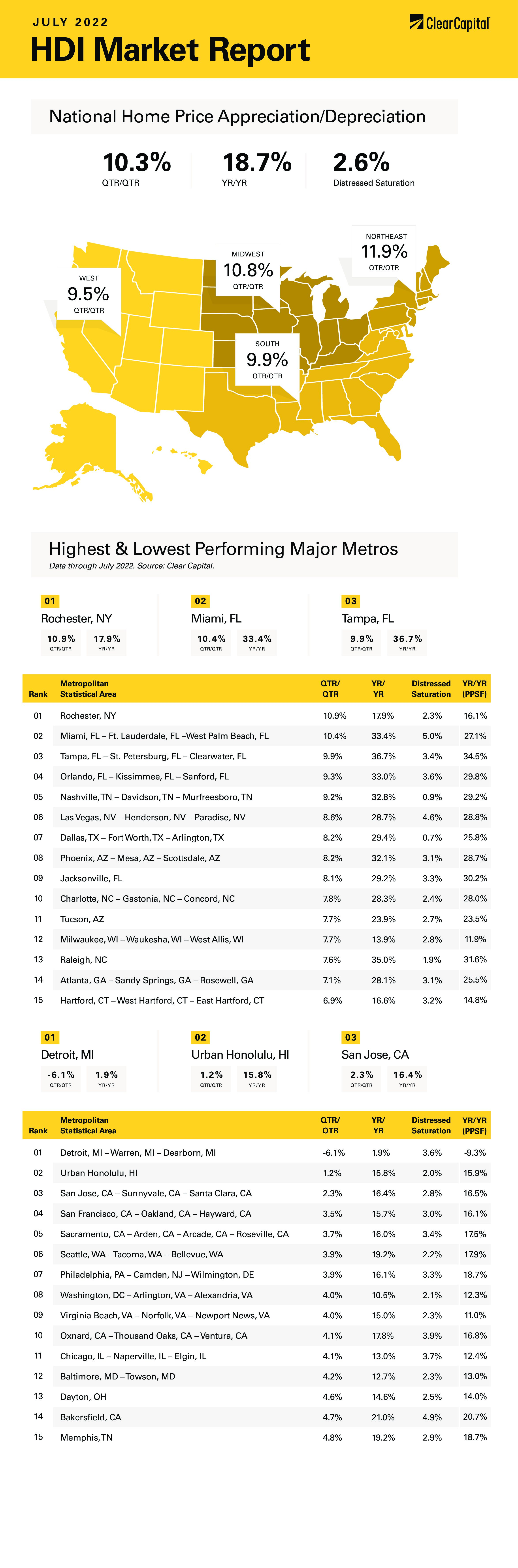

Home price appreciation maintained its pace in July as the Clear Capital Home Data Index rose 10.3% quarter-over-quarter (QoQ) and 18.7% on a year-over-year (YoY) basis. These numbers were a touch slower than June. Every region reported home price appreciation, and some of the hottest regions remain in Florida.

The South had the strongest growth at 21.7% YoY, with the usual suspects showing the most growth. The leader was Miami, where prices rose 10.4% QoQ and Tampa, where prices rose 9.9% QoQ.

The Northeast came in second, where prices rose 20% on a YoY basis. Quarter-over-quarter, the Northeast has been seeing an acceleration. In fact, the fastest-growing MSA was Rochester, NY where prices rose 10.9% QoQ and 18% YoY. Another erstwhile depressed MSA was Hartford, where prices rose 6.9% QoQ and 17% YoY. The Northeast has been a laggard since the real estate bubble burst in 2006, and perhaps prices simply became too cheap to ignore.

The West came in next, which grew 18.7% YoY. Phoenix was the leader, with prices rising 32%. Other notable Western MSAs include Las Vegas, where prices rose 29% and Tucson, where they rose 24%. Interestingly, some of the slowest-growing MSAs were the high-flyers of the past few years: San Francisco, San Jose, and Seattle all had low single-digit QoQ price appreciation.

Finally, the Midwest saw a 12.3% increase in prices YoY. Milwaukee made the top 15, with quarterly prices increasing 7.7% QoQ and 13.9% YoY. Given the rapid rise in inflation and the acceptance of work-from-home, perhaps some people are deciding to leave expensive locations and move to where there is a lower cost of living.

The first estimate of second quarter GDP came in at -0.9%, which is the second consecutive quarter of negative GDP growth. This reading has begun a battle over whether we are in a recession. Historically, the rule of thumb has been that two consecutive quarter of negative GDP growth constitutes a recession. That isn’t the official definition, however. The final determination will be made by the National Bureau of Economic Research. This is a private, non-profit and non-partisan institution. It generally decides on recessions several months after the fact.

Their definition of a recession is more subjective than something like two consecutive quarters of negative GDP growth. It also takes into account other important variables, and this is where the issue will be this time around. Historically, recessions have been associated with a weak labor market. Recessions and mass layoffs tend to go hand-in-hand.

This time around, the unemployment rate is at 3.6%, which is an exceptionally low rate by historical standards. We touched the current level right before the COVID-19 pandemic; however, it has been a long time since the labor market was this tight. We saw it in the late 1960s (when there was a military draft) and the early 1950s. Take a look at the chart below, which shows the unemployment rate going back almost 75 years. The current labor market strength is remarkable. Given that when people talk about “the economy” they are almost always referring to the labor market so I suspect the NBER will hold off on calling the current economic situation a recession.

Does the current unemployment rate mean that fears of a recession are unfounded? Certainly not. Historically, monetary policy has affected the economy with a 9-month lag. This means the rate hikes of early 2022 have yet to be felt, let alone the big increases we saw over the past two months. Those will start to impact the economy in early 2023.

If you look at the Fed Funds futures, they are predicting another 100 basis points in rate hikes by the end of the year, which puts the Fed Funds rate around 3.25%. The June 2023 Fed Funds futures are lower than December, which means that the Fed will start cutting rates by mid-2023. That means this tightening cycle is winding down, assuming of course that inflation starts moderating. So far, there is no evidence of that.

For all the fears of higher rates and a recession, real estate prices have remained resilient. Price appreciation remains above 20%, despite everything the Fed has been throwing at it. In fact, mortgage rates have been falling over the past six weeks and are down around 5.3% after peaking at 6.1% in early June, which will provide more support going forward.

The issue has always been a lack of inventory and a dearth of homebuilding. Labor and material shortages are to blame, along with a lack of land plots. It may take a drop in inflation and re-stocked inventories to get things back to normal. With work-from-home now firmly mainstream, I could see an evening out of home prices between the MSAs, as people leave expensive states like California for cheaper ones.

About the Clear Capital Home Data Index™ (HDI™) Market Report and Forecast

The Clear Capital HDI Market Report and Forecast provides insights into market trends and other leading indices for the real estate market at the national and local levels. A critical difference in the value of Clear Capital’s HDI Market Report and Forecast is the capability to provide more timely and granular reporting than nearly any other home price index provider.

Clear Capital’s HDI Methodology

• Generates the timeliest indices in patent pending, rolling quarter intervals that compare the most recent four months to the previous three months. The rolling quarters have no fixed start date and can be used to generate indices as data flows in, significantly reducing multi-month lag time that may be experienced with other indices.

• Includes both fair market and institutional (real estate owned) transactions, giving equal weight to all market transactions and identifying price tiers at a market specific level. By giving equal weight to all transactions, the HDI is truly representative of each unique market.

• Results from an address-level cascade create an index with the most granular, statistically significant market area available.

• Provides weighted repeat sales and price-per-square-foot index models that use multiple sale types, including single-family homes, multi-family homes and condominiums.

The information contained in this report and forecast is based on sources that are deemed to be reliable; however, no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.