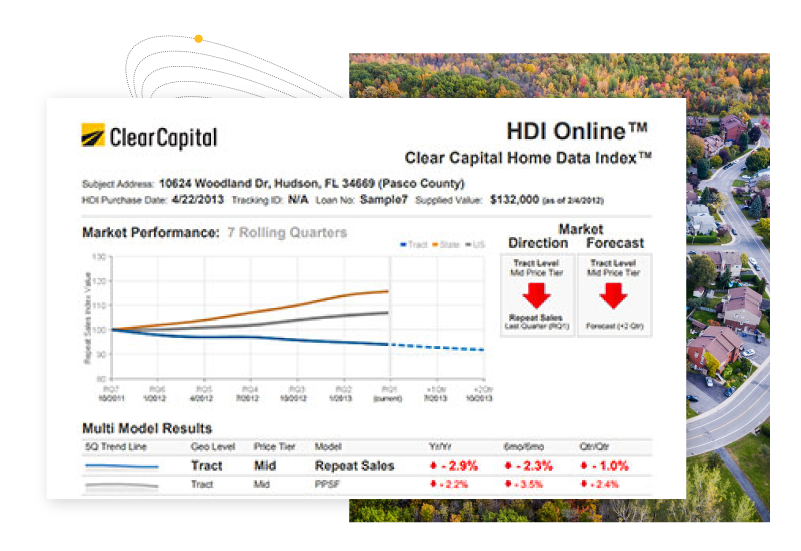

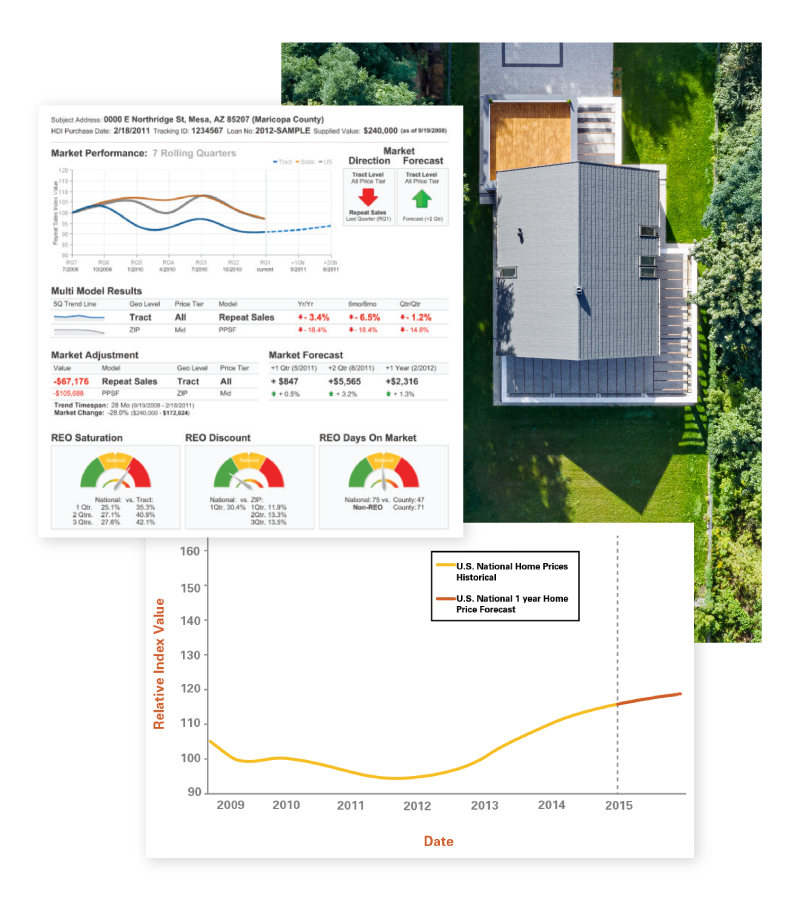

Clear Capital’s HDI calculates home price trends from any effective date, providing you with more insight and clarity for each transaction.

Clear Capital’s Home Data Index provides additional, contextual data for an even sharper valuation picture and brings additional timeliness, intelligence, and clarity to your due diligence process. HDI offers:

Make better decisions using current data, compare trends against valuations in review, or look beyond present house prices to forecast and evaluate risk.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved