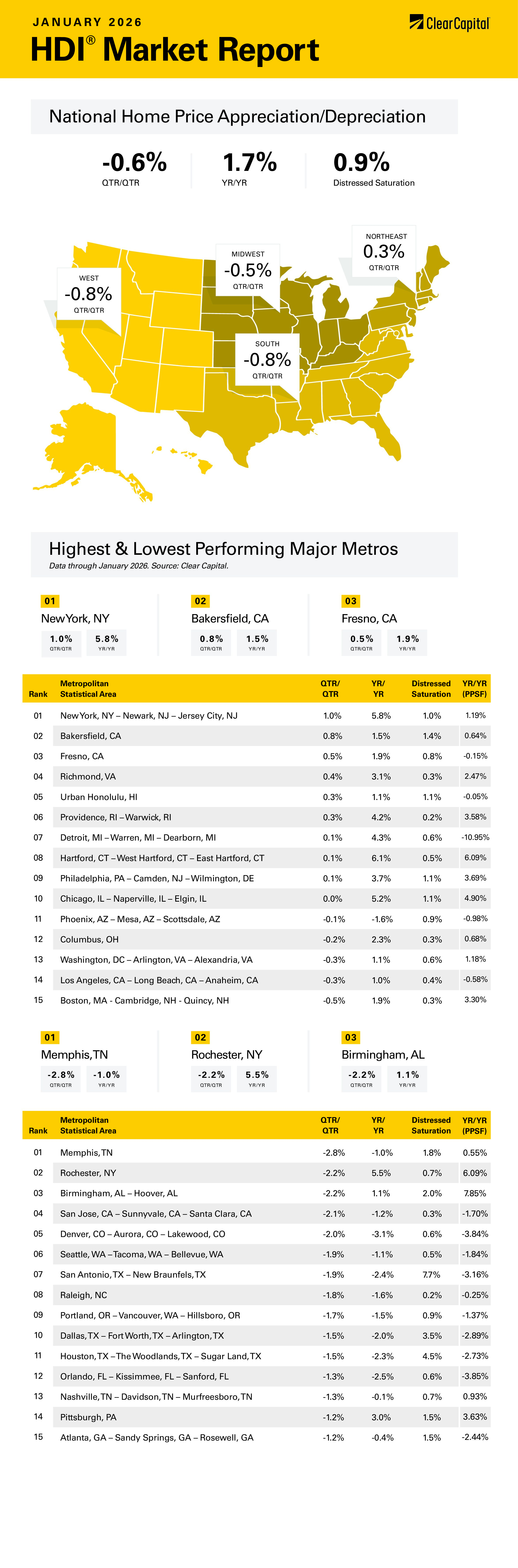

The January 2026 Clear Capital Home Data Index (HDI®) Market Report shows national quarter-over-quarter home price growth is at -0.6 percent.

Download the report, or read it below.

Commentary by Brent Nyitray of The Daily Tearsheet

Home price appreciation decelerated in January, according to the Clear Capital Home Data Index. Nationally, home prices fell 0.6% on a quarterly basis and rose 1.7% annually. The Northeast is still exhibiting quarterly and annual growth, while the West, Midwest, and the South are negative on a quarterly basis. Of the top 15 Metropolitan Statistical Areas (MSA), nine experienced positive quarterly growth, one experienced no growth, and five had negative growth.

The Northeast was the top market, rising 0.3% quarterly and 4.9% annually. The top Northeastern MSA was New York City, where prices grew 1.0% on a quarterly basis and 5.8% annually. Providence, RI was also a leader, rising 0.3% on a quarterly basis and 4.2% annually. In Hartford, CT, prices rose 0.1% on a quarterly basis and 6.1% annually. After being one of the leading Northeastern MSAs, Rochester, NY saw a quarterly decline of 2.2%, however annual price growth was still solid at 5.5%. This is the third month where Rochester showed negative quarterly growth.

The Midwest was the next-best performer on a quarterly basis, with prices falling 0.5% but rising 4.1% annually. Detroit was the top performer, with prices increasing 0.1% on a quarterly basis and 4.3% on an annual basis. Chicago was also a top performer with prices flat on a quarterly basis and up 5.2% annually.

The South came in third, where prices fell 0.8% on a quarterly basis and declined 0.1% on an annual basis. Richmond, VA was the top performer, with prices up 0.4% on a quarterly basis and up 3.1% annually. Washington, DC saw prices fall 0.3% on a quarter-over-quarter (QoQ) basis but increase 1.1% annually. Memphis, TN was the lowest performing MSA, where prices fell 2.8% on a quarterly basis and 1.0% annually. Birmingham, AL also struggled, with prices down 2.2% quarterly, although annual appreciation was still positive at 1.1%.

The West came in last, where prices fell 0.8% on a quarterly basis and exhibited negative year-over-year (YoY) growth of 0.3%. The top Western MSA was Fresno, CA, where prices rose 0.5% quarterly and 1.9% annually. Bakersfield, CA was also in the top 15, with prices increasing 0.8% quarterly and 1.5% annually. The worst performing MSA was Denver, where prices fell 2.1% on a quarterly basis and 3.1% on an annual basis. Seattle also struggled, with prices falling 1.9% on a quarterly basis and 1.1% on an annual basis. San Jose, CA also got roughed up, with prices falling 2.1% on a quarterly basis and 1.2% annually.

Home price appreciation has clearly hit a brick wall over the past year and is threatening to flatline or even go negative. Given that interest rates have been falling, it would imply that affordability is improving. And that is true, if you look solely at principal and interest payments as a percentage of income. That number has been falling since 2022.

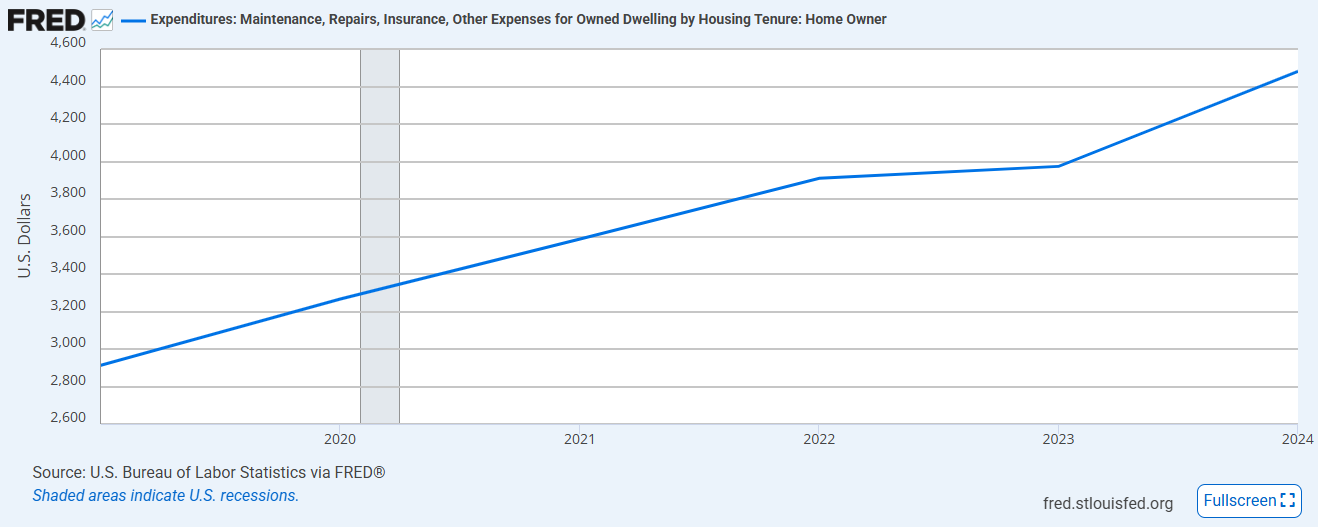

On the other hand, escrow payments have been increasing at a serious clip. Escrow payments are the portion of the homeowner’s mortgage payment that accounts for taxes and insurance. According to Cotality, escrow payments have increased by 45% over the past 5 years. If you look at FRED data, from 2018 through the end of 2023, insurance, maintenance and repairs have increased 53%, and this is before the acceleration of insurance premiums in 2024 and 2025. At the end of 2023, the typical homeowner was paying $4,500 a year for insurance, maintenance and repairs. First time homebuyers often underestimate the cost of maintenance, escrow and closing costs.

In 2024, homeownership policy rates rose a whopping 17.4%, and are estimated to have risen another 8% in 2025, reaching $2,927 for the typical homeowner. The increase in insurance costs reflects home price appreciation, natural disaster risks and increasing repair costs. Location also matters a lot, and Florida has been ground zero for this increase.

Cotality estimates that escrow payments have increased 70% since 2019 in the state of Florida. This is being driven mainly by insurance premiums and HOA assessments for structural upgrades after the Surfside collapse. The escrow portion is now 38% of the monthly mortgage payment. No wonder home prices are falling there. Whatever affordability that existed five years ago is long gone. Seniors living on a fixed income are getting crushed by these price hikes.

Homeowners insurance isn’t going to make or break a homeownership decision for most people, but it can mean that a payment that barely passes the debt-to-income ratio at origination can become unaffordable in a hurry. High home price appreciation has masked some of these issues in the past. Now that the housing market is tougher, credit analysis is much more important. This is particularly acute in business purpose lending, especially mortgages which cover rental properties.

Asking rents have been declining on a year-over-year basis since June of 2023 according to Apartment.com. After peaking in August of 2022 at $1,442, asking rents have recently fallen to $1,353. Vacancy rates are hitting new highs. This is removing some of the margin of safety that lenders build into these loans. With private credit stocks getting hammered lately by big write downs, the credit markets could tighten at a moment’s notice. Debt Service Coverage Ratio loans (DSCR) will be the first to feel the impact.

Collateral is an important part of credit analysis and when home price appreciation falls appraisal values get a harder look. Buy-side investors in non-QM paper are demanding documentation to support increased appraisal values. Fannie and Freddie are also taking a hard look at appraised valuations and sending repurchase requests to lenders when they dispute the valuation. Business purpose loans are routinely requiring second appraisals and / or desktop appraisals. Clear Capital’s solutions are an important tool which keeps lenders out of harm’s way.

About the Clear Capital Home Data Index (HDI®) Market Report and Forecast

The Clear Capital HDI Market Report and Forecast provides insights into market trends and other leading indices for the real estate market at the national and local levels. A critical difference in the value of Clear Capital’s HDI Market Report and Forecast is the capability to provide more timely and granular reporting than nearly any other home price index provider.

Clear Capital’s HDI Methodology

• Generates the timeliest indices in patent pending, rolling quarter intervals that compare the most recent four months to the previous three months. The rolling quarters have no fixed start date and can be used to generate indices as data flows in, significantly reducing multi-month lag time that may be experienced with other indices.

• Includes both fair market and institutional (real estate owned) transactions, giving equal weight to all market transactions and identifying price tiers at a market specific level. By giving equal weight to all transactions, the HDI is truly representative of each unique market.

• Results from an address-level cascade create an index with the most granular, statistically significant market area available.

• Provides weighted repeat sales and price-per-square-foot index models that use multiple sale types, including single-family homes, multi-family homes and condominiums.

The information contained in this report and forecast is based on sources that are deemed to be reliable; however, no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.