Expedite valuations, mitigate risk, and lower costs with our suite of real estate valuation solutions for home equity lending.

We provide a wide range of high-quality products, from traditional appraisals to alternative valuations.

Access valuation solutions supported by supplemental data points on 139 million properties.

Get reliable, accurate, and compliant results.

Quickly assess the subject property, market trends, neighborhood, and comparables.

Explore our range of high-quality products and find tools for all your lending needs.

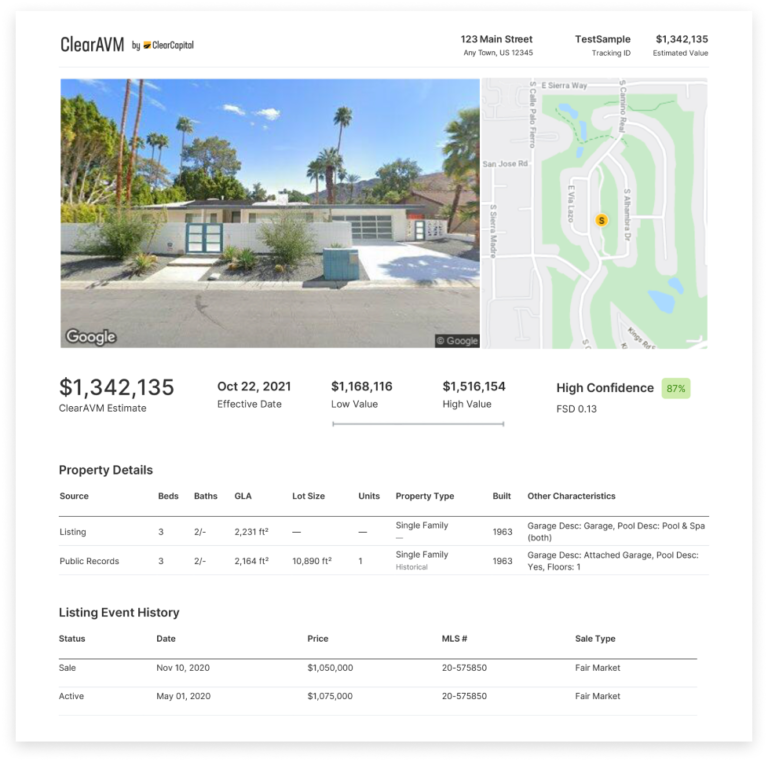

Our industry-leading, lending-grade automated valuation model. Designed to handle a high volume of property valuations quickly and accurately.

Get rapid condition updates on residential and commercial properties from experienced and trained professionals. Pair with ClearAVM for a compliant evaluation.

An efficient property data gathering service that delivers GSE data standards in support of inspection-based appraisal waivers and hybrid appraisals.

A bifurcated appraisal that is GSE-compliant and up to 50% faster than a traditional appraisal for purchase and refinance home loans.

Completed by an appraiser from our national appraisal management company and fits a variety of lending needs.

For a full list of all of our products, visit our product page.

ClearAVM is one of the industry’s best lending-grade AVMs. It can handle a high volume of property valuations quickly and accurately.

Understand a property's condition with ClearAVM combined with a boots-on-the-ground broker/agent external and/or internal property condition inspection (PCI).

An automated valuation model with accuracy across 139+ million addresses nationwide.

ClearAVM can be used for primary valuations on second liens and seasoned performing loans.

Certified property data, an ANSI-aligned gross living area (GLA), and 2D floor plan are collected and provided to a geo-competent appraiser to easily complete the 1004 Hybrid/70H appraisal.

Our program was co-developed with and designed for the major investors and top lenders. We’re actively expanding with additional investors.

Completed by a licensed appraiser from Clear Capital’s national appraisal management company (AMC).

Order a traditional appraisal for foreclosure and other high-risk property valuation situations with a high estimated value or high complexity.

Learn how our suite of real estate valuation solutions for home equity lending can expedite turn times, save on costs, and reduce manual efforts.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2025 ClearCapital.com, Inc. All Rights Reserved