Temporary appraisal flexibilities require data for all relevant property characteristics, including interior condition

4 min read

The global spread of COVID-19 has affected every industry, including real estate valuation. In many cases, an appraisal based on a full interior and exterior inspection of the property has been unobtainable.

In response, Fannie Mae and Freddie Mac, under the guidance of the Federal Housing Finance Agency (FHFA), set forth temporary flexibilities to appraisal requirements. These temporary flexibilities have been extended until June 30, 2020 and allow desktop and exterior-only appraisals in certain situations, outlined in more detail below.

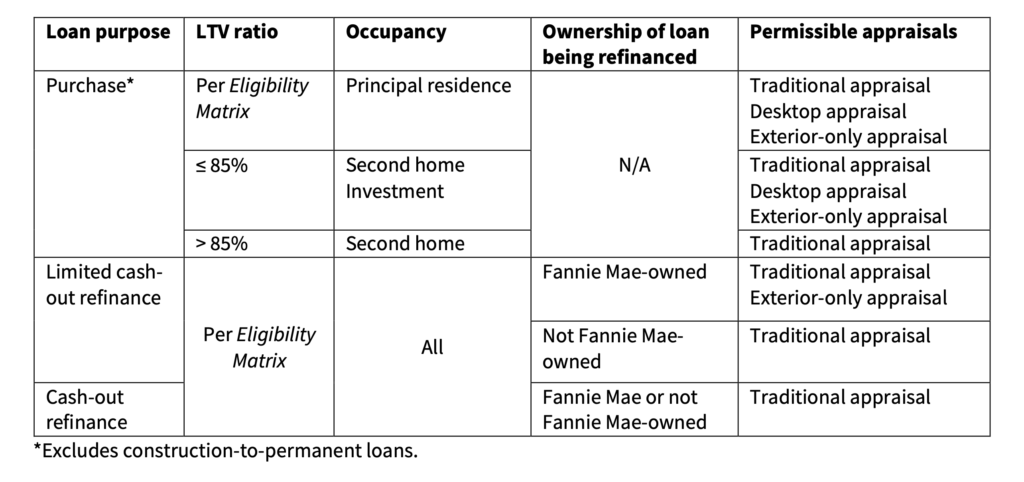

Fannie Mae’s appraisal flexibility guidelines:

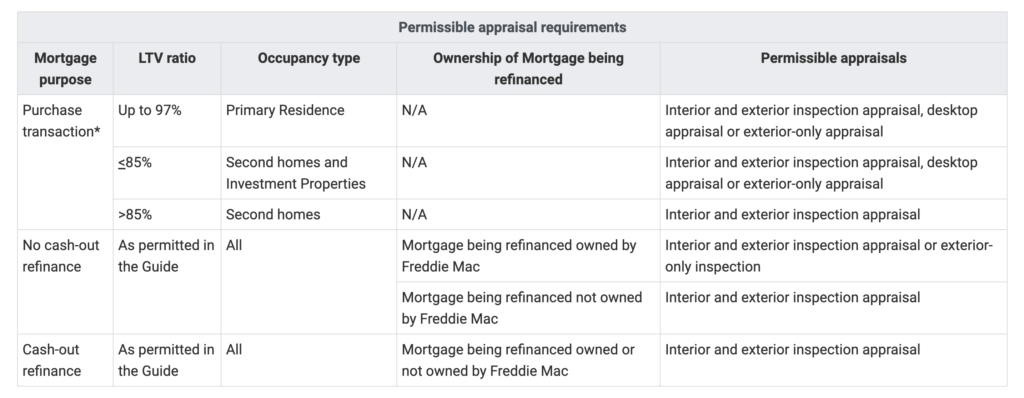

Freddie Mac’s appraisal flexibility guidelines:

No assumptions allowed

In a recent appraiser update email, Fannie Mae wrote:

“…one issue we’ve observed is that some appraisals rely on assumptions about the subject property condition. Whether completing an exterior-only or a desktop appraisal, the appraiser must have a data source for all the relevant characteristics including interior condition. Obtaining that information, whether it be from homeowners or other sources, is not only encouraged, but is required.

…

When using the temporary flexibilities, we encourage appraisers to communicate with homeowners or agents to fill any gaps in the descriptive information needed to perform the appraisal. The appraiser cannot assume that the condition is ‘average’ or ‘similar to the exterior of the home,’ for example.”

This recent guidance — that assumptions (including extraordinary assumptions) are not allowed — is a change to a longstanding practice.

That said, obtaining the needed descriptive information can create more busy work like back-and-forth emails and calls to explain what information the appraiser needs. Video walkthroughs using FaceTime or Skype can be frustrating and still require scheduling.

As a real estate valuation technology company, we knew we could make the process easier on appraisers and homeowners. So we built a free tool called OwnerInsight™, designed to hand flexibility back to the appraiser and enable mortgage processes to move forward in a compliant way while limiting in-person interaction.

How OwnerInsight works

OwnerInsight provides a simple and secure way to meet appraisal data requirements by allowing appraisers to quickly request and receive interior appraisal info and photos from home occupants. All that’s needed is a property address and the occupant’s contact information, and appraisers receive timely information from inside homes they are unable to physically enter because of COVID-19.

A simple, four step process:

The benefits of OwnerInsight include:

- Saves time by eliminating lengthy and confusing back-and-forth with home occupants

- Eliminates scheduling and enables proper social distancing practices

- Satisfies FHFA, Fannie Mae, Freddie Mac and other regulatory guidelines

- Improves inspection consistency with built-in fraud mitigation

- Guides the home occupant through a simple, step-by-step process to ensure consistent, high-quality photos and information

- Incredibly easy to use, web-based, and no installation necessary

- Nationwide solution, free for all appraisers

Removal of certification 10

The standard appraisal forms include certification 10 that obligates the appraiser to verify “from a disinterested source, all information in this report that was provided by parties who have a financial interest in the sale or financing of the subject property.”

It’s important to note that certification 10 was intentionally removed from the temporary appraisal flexibility certifications in recognition that there may be scenarios where an interested party (the borrower, realtor, property contact, etc.) is the only available source for some subject property data.

Consistent with USPAP, appraisers are permitted to consider and develop any information deemed credible.

Helpful resources

Clear Capital:

Webinar: “Understanding Appraisal Flexibilities During COVID-19”

Fannie Mae:

Lender Letter LL-2020-04, Impact of COVID-19 on Appraisals

Top 6 Tips for Appraisers on Using COVID-19 Flexibilities

Freddie Mac:

Selling Guidance Related to COVID-19

Fannie Mae appraiser update email

Below is Fannie Mae’s appraiser update email sent Wednesday, May 13, 2020 at 1:47 p.m. PT with the subject line, “No assumptions allowed (on property condition).”

—————

As Fannie Mae has begun to examine appraisals completed using our temporary appraisal flexibilities in Lender Letter LL-2020-04, Impact of COVID-19 on Appraisals, one issue we’ve observed is that some appraisals rely on assumptions about the subject property condition. Whether completing an exterior-only or a desktop appraisal, the appraiser must have a data source for all the relevant characteristics including interior condition. Obtaining that information, whether it be from homeowners or other sources, is not only encouraged, but is required. This is addressed in the FAQs regarding the temporary flexibilities (Q47):

As stated in Lender Letter LL-2020-04, the appraiser’s certification #10 was removed recognizing that the appraiser may have to rely on information from an interested party to the transaction (borrower, real estate agent, property contact, etc.) and additional verification may not be possible. The removal of this certification acknowledges this could affect the assignment’s results. If adequate information is not available to complete the appraisal, the assignment cannot be completed.

The standard GSE appraisal forms include certification 10 that obligates the appraiser to verify “from a disinterested source, all information in this report that was provided by parties who have a financial interest in the sale or financing of the subject property.” We intentionally removed certification 10 from the revised certifications, required for our temporary appraisal flexibilities, in recognition that there may be scenarios where an interested party is the only available source for some subject property data. When using the temporary flexibilities, we encourage appraisers to communicate with homeowners or agents to fill any gaps in the descriptive information needed to perform the appraisal. The appraiser cannot assume that the condition is “average” or “similar to the exterior of the home,” for example.

The temporary appraisal flexibilities have been extended through June 30. You can get tips on how to gather sufficient information in our Top 6 Tips for Appraisers on Using COVID-19 Flexibilities video. As a reminder, you can access the Lender Letter, FAQs, videos, and other resources on the Appraisers Page, and you can submit any questions you have using the Contact Us link.

Feel free to forward this information, and if you aren’t already receiving these emails you can sign up for them from the Appraisers page.

Visit the Appraisers page for newsletters, training, and more

—————