We’re at an exciting inflection point in our industry, as new technologies and approaches to home appraisals are being tested and advanced with encouraging success, and as we have important conversations around appraisal accuracy and the potential of valuation bias.

The recent release of the FHFA RFI requesting public comment on appraisal modernization (responses due by February 26, 2021) will bring about some productive and helpful conversations that will help determine our future course.

Against that backdrop of positive momentum, we’re going to spend some time digging into a subject that may seem trivial but is in fact massively important to the future of our industry: gross living area (GLA).

I know what you’re thinking: “GLA? How could that possibly be important to the future of the mortgage industry? What’s so interesting about this subject?”

By the end of this blog series, you’ll understand why moving to a new method of digitally capturing GLA and automating the floor plan will help usher in a new era of better quality appraisals and unlock innovative new ways of performing valuations.

Over the course of this three-part series, we’ll explore:

- The limitations of traditional methods for capturing gross living area

- Exciting new technologies that can modernize and democratize it

- What powerful consumer and appraiser benefits a new “digital GLA” can unlock

This first post focuses on point one — let’s dig in.

Part one: the limitations of traditional GLA

Besides locational influences, a home’s physical size is perhaps the single biggest contributor to its value. As such, accurately capturing dimensions is essential to getting a credible appraisal. Unfortunately, securing accurate GLA today can be challenging, even in the longstanding traditional appraisal process.

Limitation #1: inconsistent application of principles

Today, appraisers don’t utilize consistent measurement principles in traditional appraisal work. While all appraisers are certainly skilled and capable at measuring and sketching, from appraiser to appraiser there is often variation in how they perform the task that can impact the integrity of the GLA datapoint found in appraisals.

Some appraisers measure to the nearest foot, some to the nearest half-foot, some to the nearest inch. There are also inconsistencies in how appraisers treat stairwells, basements, and more. For such a critical data point, significant variances currently exist in how square footage is collected.

To quantify the level of inconsistency in the traditional appraisal process, we dug into almost 300 properties where Clear Capital fulfilled two different 1004/70 (URAR) appraisal reports on the same property, with two different appraisers within a short time period.

Because there’s an element of human error in the traditional GLA process — as well as the inconsistent application of principles — the results show noticeable variances.

GLA comparison: two different appraisers measuring the same property

| Sample size of properties | 285 |

| Average GLA variance | 3.9% |

| Percent of properties with significant GLA variance* | 4.9% |

| Standard deviation of variance | 8.0% |

*Defined as a variance of 15 percent or greater

The most important takeaway: There is already significant inconsistency in the GLA calculations that the appraisal industry is producing today. The notion of “ground truth” is something we shouldn’t assume is perfectly captured in any human-directed process. Any analysis of accuracy that we make of new digital GLA technologies must recognize that the current approach is not a perfect standard.

Limitation #2: limited fidelity of a traditional appraisal floor plan

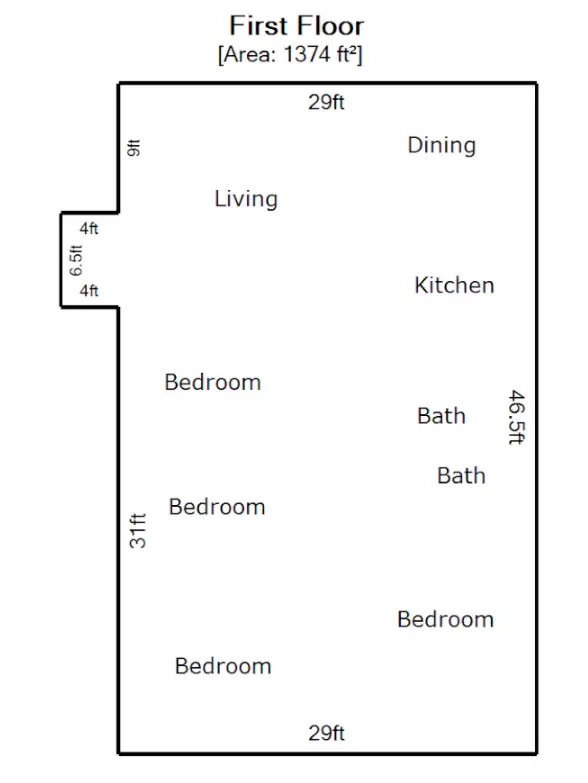

Traditional appraisal sketches offer very little visual detail to help the end-user of the report understand the flow of the home. Here’s an example:

The information imparted by a typical appraisal sketch is only the exterior wall locations and a vague sense of where the different rooms in the home are located (even when sketches include some additional detail, it’s usually rudimentary). What’s typically missing or lacking detail:

The information imparted by a typical appraisal sketch is only the exterior wall locations and a vague sense of where the different rooms in the home are located (even when sketches include some additional detail, it’s usually rudimentary). What’s typically missing or lacking detail:

- Location of interior walls

- Location of doorways

- Location of windows

- Walk-in closets

- Key interior features such as kitchen islands, bathroom fixtures, and more

- Without an adequate level of detail, collateral reviewers get very little insight into the property from the sketch.

Limitation #3: learning to measure and sketch a home with accuracy is hard

Learning to measure and sketch a home with accuracy takes considerable time and effort. Take it from us — we’ve successfully certified more than 800 non-appraiser data collectors nationwide in how to do it as part of our offering in hybrid appraisal programs! We’re extremely proud of the high-quality work our data collectors deliver with respect to measurement, but it’s taken a multi-year, “all-hands-on-deck” effort to hit this scale and coverage.

Put differently: Perhaps the greatest hindrance to the growth of non-appraiser property data collection in the hybrid appraisal program is the consistent production of an accurate and reliable floor sketch and GLA. It may sound like a trivial thing, but it’s massively important.

With a future of digital GLA where sketches can be accurately automated with minimal training, it opens up massive scaling opportunities for appraisal modernization efforts to grow and give appraisers and lenders elite-level quality in perhaps the most challenging data element to get right.

Limitation #4: an interested party can’t provide GLA

With the explosion of homeowner-assisted appraisal assignments that have taken place during the pandemic, there is no way to validate the property’s actual size. A homeowner can’t accurately measure the property given their lack of training — and even if they were trained, you couldn’t trust an interested party to provide a reliable GLA. They may “accidentally” inflate the number in an attempt to goose up the value.

Suppose homeowner-assisted data collection is going to play a role in the future of appraisal after the pandemic subsides. In that case, we’ll need tools that enable an interested party to collect GLA information in a manner that is free from their influence. Our industry’s reliance upon traditional, hand-drawn and calculated GLA prevents that from happening.

So, how can we evolve to the next level?

The answer lies in embracing the thoughtful use of exciting new technologies, which we’ll outline in our next blog post in this series. By moving to an automated floor plan and digital GLA, we can address our current process. We can deliver standardized, consistent, highly-detailed sketch and GLA outputs using smartphone technology that anyone with a smartphone can use with little-to-no training.

In our next blog post, we’ll dive into the details of a Finland-based technology startup called CubiCasa, which has some exciting new approaches that will bring automated floor plan and digital GLA to life for our industry.