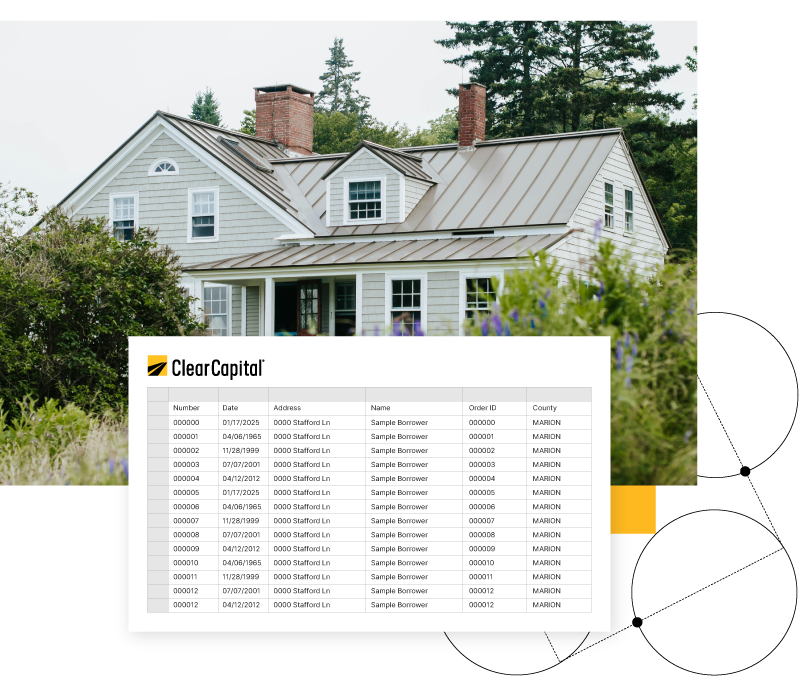

Current and historical Mortgage Data provides a transparent look into a property’s financing status as recorded in county public recorders and municipal offices.

Offered through PropertyNova™, our Data-as-a-Service suite of property data products, Mortgage Data offers improved data quality, flexible delivery and subscription models, and a dedicated support team to ensure you make the most of this powerful data.

We improve the data quality, delivering standardized values directly to you. More reliable and accurate information enables better decision-making.

Get responsive, knowledgeable assistance from our customer support team to help you unlock the full value of the dataset and integrate it seamlessly into your workflows.

Unlock richer property intelligence by bundling Mortgage Data with Tax Assessment Data, Recorder Data, and valuation products like ClearAVM™ and Home Data Index (HDI®) bulk files.

Mortgage Data features improved quality, configurable delivery and subscription models, and a dedicated support team to ensure you make the most of this powerful data.

Data fields

Coverage of U.S. homes

Years of data

Mortgage details

Pre-foreclosure information

Assignments and releases

Get started with Mortgage Data to leverage robust, comprehensive property data.

We’ll keep you in the loop on the latest stories, events, and industry news.