In Real Estate Appraisals A Photo is Worth A Thousand Words

From informing medical diagnostics to measuring investor sentiment, using technology to scan images has brought revolutionary advancements across fields. But for underwriters, the collateral appraisal review process is still painstakingly slow. To accurately asses the quality of an appraisal, they manually comb through a mountain of appraisal photos, carefully evaluating each one for errors and usability in an appraisal review.

Subject property photos, including interior and exterior images, are considered a minimum to meet qualified appraisal requirements. To ensure an appraisal report is compliant, underwriters need to verify high-quality photos of the subject property and that review takes time. And for those in the mortgage industry, time is constrained and comes at a cost.

Why Lenders Need High-Quality Appraisal Photos

In order to asses the risk of the collateral, lenders require high-quality appraisal photos of every room in the home. It’s not uncommon to request photos of ceilings, crawl spaces, and even smoke detectors to confirm the health and safety of the occupants. Appraisal photos help lenders verify the condition of the property and ensure the value is supported in line with their investor guidelines. And the Federal Housing Administration (FHA), Fannie Mae, and Freddie Mac all have specific requirements for appraisal photos.

FHA Appraisal Photo Requirements

FHA appraisal photo requirements are rigorous and if an appraisal is rejected, it is often due to photo errors. According to Working RE Magazine, a whopping 50% of appraisals are returned to home inspectors for revision. Of the top ten reasons for revision, two are related to photo errors. This constant cycle of review-submit-revise-submit costs lenders, AMCs, and appraisers millions of dollars each year.

The Federal Housing Administration (FHA) states that to secure an FHA loan, photos of all four sides of the home exterior must be included as well as photos of the attic, street scenes, and comparable sales. Additionally, when an FHA appraisal is used, the Department of Housing and Urban Development (HUD) requires the home appraiser to guarantee that the subject property meets the minimum standards for health and safety. This is why numerous appraisal photos are required in the appraisal review process.

Fannie Mae and Freddie Mac Appraisal Photo Requirements

Fannie Mae and Freddie Mac appraisal photo requirements generally adhere to the same guidelines. Freddie Mac’s appraisal requirements include original, electronic, and color photographs that illustrate the property features. For example, real estate appraisal photos must be clear, correctly labeled, and show any home improvements or blemishes. This includes photos showing physical deterioration, amenities, or external influences that could affect the market value or marketability of the subject property.

Whether you’re underwriting or reviewing a Fannie Mae or Freddie Mac loan, the sheer volume of appraisal photos can be overwhelming.

Appraisal Photo Review Solutions

Now, amazing developments in machine learning are reinventing the appraisal review process. In fact, it has never been easier to reduce the time it takes to underwrite an appraisal while minimizing risk and increasing profitability. Technology can now instantly detect photo-related errors.

Recently, Clear Capital launched ClearPhoto™, an appraisal photo review tool available to underwriters and reviewers through ClearCollateral® Review — Our automated collateral underwriting review system. With the inclusion of ClearPhoto, assessing property photos and ensuring they align with appraisal data and floor plan sketches can be done using AI-driven technology. In short, ClearPhoto was developed to streamline the appraisal review process.

Detect Appraisal Photo Errors with ClearPhoto™

With ClearPhoto, ClearCollateral Review conducts critical checks throughout the review process including:

- Confirmation that each photo is correctly labeled

- Validation that the number of unique rooms shown in imagery matches the appraisal data for bedrooms, bathrooms, and kitchensValidation that the number of bedrooms, bathrooms, and kitchens in the sketch matches the appraisal data

ClearPhoto™ Speeds the Photo Review Process

ClearCollateral Review currently handles over one million automated underwriting decisions montly. With the introduction of ClearPhoto, ClearCollateral Review automatically reviews appraisal photos using remarkable technology — cutting down on time reviewers spend analyzing thousands of property images. Additionally, it provides meaningful context to photos, which helps achieve higher-quality appraisals and empowers reviewers to make better underwriting decisions.

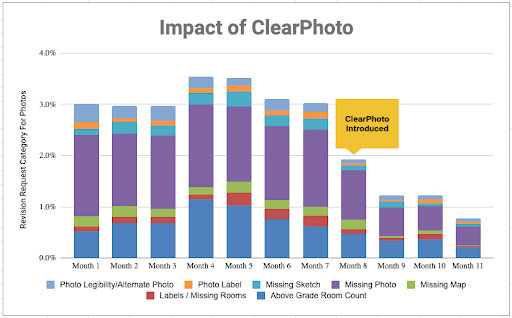

ClearPhoto also reduces time identifying photo error(s) and does an instant check for accuracy and quality. To demonstrate the impact, ClearPhoto was tested on over 100,000 appraisals. As shown in the chart below, the average photo-related errors or revision requests were around 3% before using ClearPhoto. Afterward, photo-related issues decreased to just over 1% and continue to trend downwards.

Watch ClearPhoto™ in Action

To learn more about ClearPhoto, you can watch this short video by Product Manager Leah Campbell:

The Future of Appraisal Photo Reviews

With the launch of ClearPhoto, a reviewer can reduce the effort it takes to manually go through photos and identify errors. Now, integrating technology into the appraisal review process is seamless and crucial to stay at the forefront of the lending industry.

If you’re interested in learning more about ClearPhoto or integrating ClearCollateral Review into your appraisal review system, reach out! We serve our customers with uncompromising service and remarkable technology. Clear Capital provides tools that speed loan decisions, analytics that give real-time market insights, and valuation solutions that provide professional expertise on the condition, quality, and value of a property.

Copyright © 2022 Clear Capital. Clear Capital® and the Clear Capital logo are trademarks of ClearCapital.com, Inc. or its subsidiaries. All rights reserved.