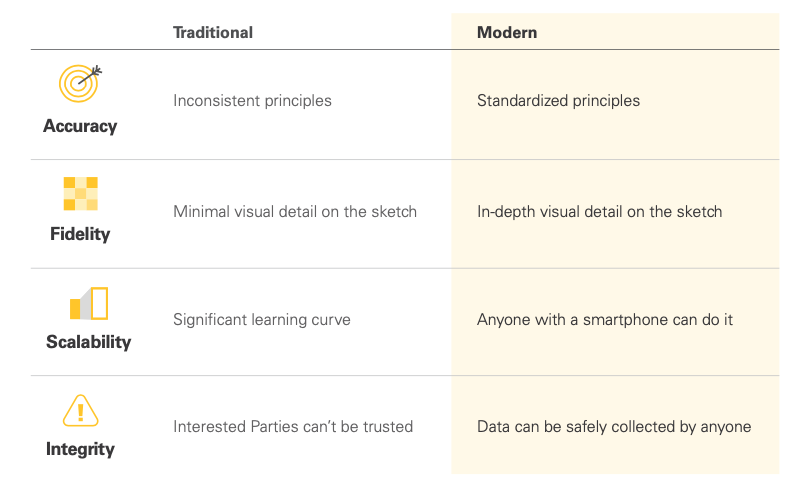

Welcome to the second blog post in our three-part series, “Automated floor plans and digital GLA — the key to unlocking appraisal modernization.” Our first post examined the recognized limitations of the traditional hand-drawn floor plans and gross living area (GLA):

- Inconsistent application of GLA principles

- Limited visual fidelity of traditional floor plans

- Learning to measure and sketch homes with accuracy is hard

- An interested party can’t provide GLA

In this post, we’ll explore what a new “digital GLA” should look like to address the limitations of traditional GLA. And we’ll close with a deep dive on an exciting new Finland-based company — CubiCasa — and their magical new technology that’s bringing “digital GLA” to life in the real estate industry as we speak.

Digital GLA: an evolution above traditional GLA

To understand what we mean by “digital GLA,” we simply need to turn the problems with hand-drawn traditional GLA on their heads and imagine the opposite of each limitation.

Imagine a world where anyone with a smartphone and practically no training — even homeowners — could automatically produce a dimensionally-accurate and richly-detailed floor plan with GLA calculations.

Imagine a world where anyone with a smartphone and practically no training — even homeowners — could automatically produce a dimensionally-accurate and richly-detailed floor plan with GLA calculations.

That would be cool, right? Cooler than the other side of the pillow!

Clear Capital has been searching far and wide for this kind of technology for several years. We’re extremely excited to say that we’ve finally found it with CubiCasa.

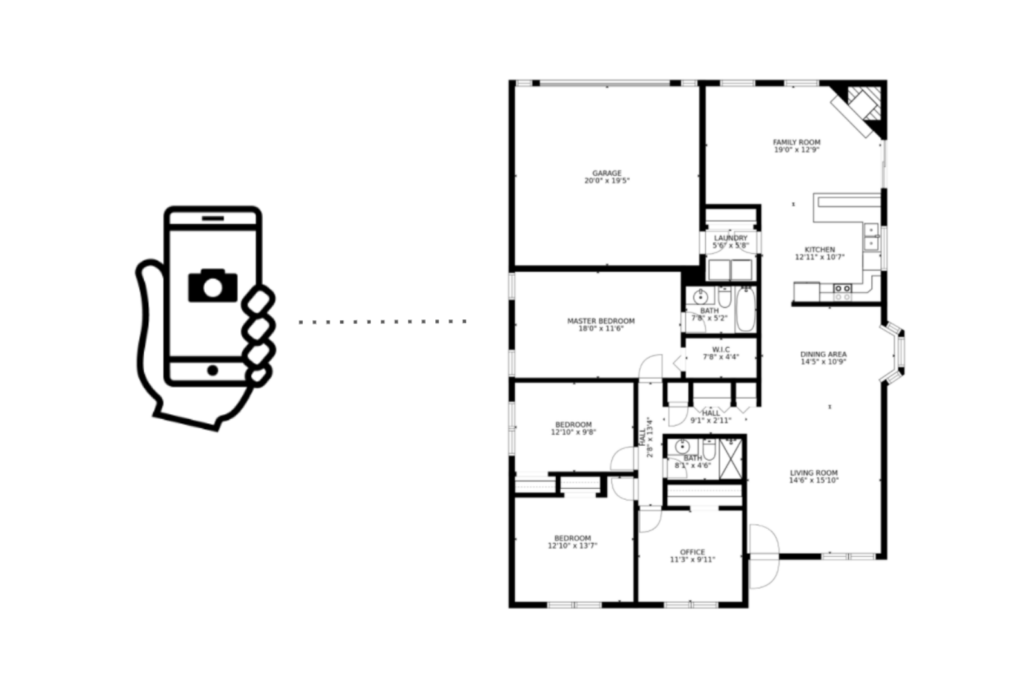

How does CubiCasa work?

It’s a simple two-step process:

- Perform a five to ten-minute walkthrough using your smartphone to “scan” the home, following the helpful guided prompts in the CubiCasa toolset.

- A few hours later, receive back a detailed, high-fidelity, accurately-measured floor plan sketch, including the GLA.

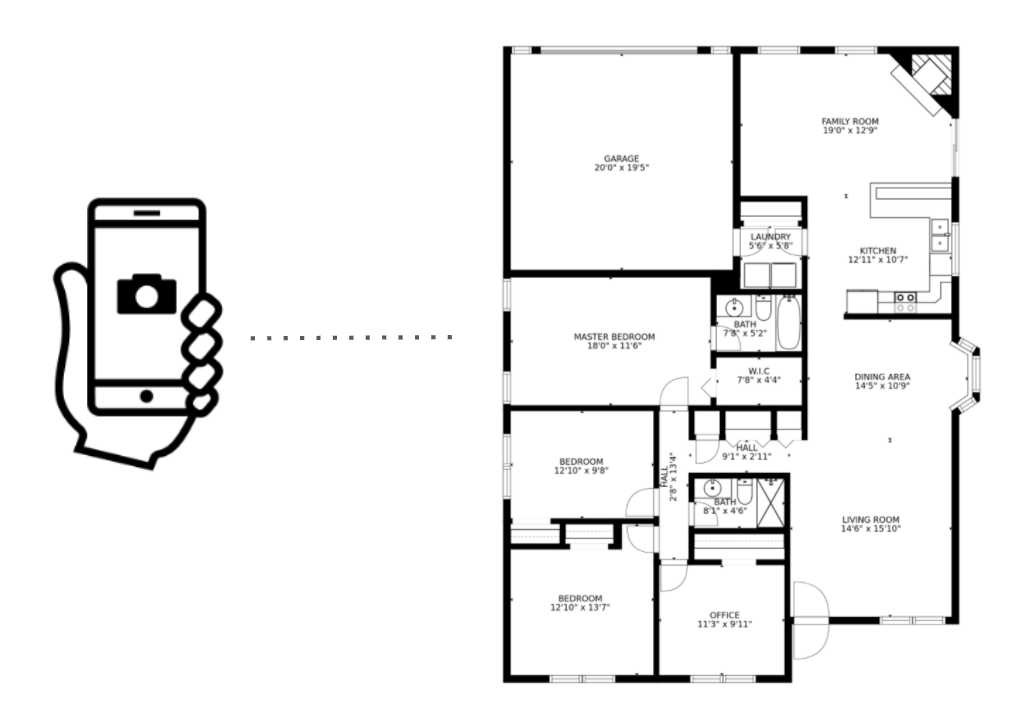

CubiCasa uses advanced image-recognition technology and a robust QA process to convert your smartphone scan into the high-fidelity sketch and measurements you see here, which meets appraisal standards and requirements.

CubiCasa uses advanced image-recognition technology and a robust QA process to convert your smartphone scan into the high-fidelity sketch and measurements you see here, which meets appraisal standards and requirements.

Perhaps best of all, CubiCasa’s stunning new mobile scanning technology is available to seamlessly integrate into any mobile app experience through a software development kit (SDK). This means that any company in the mortgage industry could embed this technology easily into their existing products, exploding the creative possibilities our market can bring to bear with it.

Clear Capital is now in the process of integrating this technology directly into a cutting-edge mobile app — ClearInsight™ — which supports property data collection for multiple appraisal modernization programs, and will be made available for licensing later in 2021.

To ensure CubiCasa’s technology can support our industry’s needs, Clear Capital performed robust testing in our ClearLabs™ group. Below are some compelling insights from our testing.

CubiCasa is more consistent than hand-drawn traditional methods

From our last post, you may recall that the current hand-drawn traditional GLA methods are prone to inconsistency and human error. As a reminder, here’s data showing how far apart two highly-trained appraisers can be when measuring the exact same property:

GLA comparison: two different appraisers measuring the same property

| Sample size of properties | 285 |

| Average GLA variance | 3.9% |

| Percent of properties with significant GLA variance* | 4.9% |

| Standard deviation of variance | 8.0% |

*Defined as a variance of 15 percent or greater

To evaluate how CubiCasa would compare to these standards set by traditional methods of calculating GLA, we had two different, untrained homeowners perform a CubiCasa scan on the same property. Let’s compare the preliminary results of this kind of testing:

| Two different appraisers hand-measuring the same property | Two different untrained homeowners scanning the same property with CubiCasa | |

| Sample size of properties | 285 | 43 |

| Average GLA variance | 3.9% | 4.0% |

| Percent of properties with significant GLA variance* | 4.9% | 0.0% |

| Standard deviation of variance | 8.0% | 3.5% |

*Defined as a variance of 15 percent or greater

As you can see from the table above, CubiCasa matches the accuracy of the current traditional appraisal sketching process, but with dramatically less inconsistency and variance in results. The standard deviation of two different appraisers is more than double that of what we see with CubiCasa.

Bear in mind that this is a test using untrained homeowners — the greatest degree of difficulty we could find. We’re confident that these already impressive results could be improved even further when utilized by trained property data collectors or appraisers.

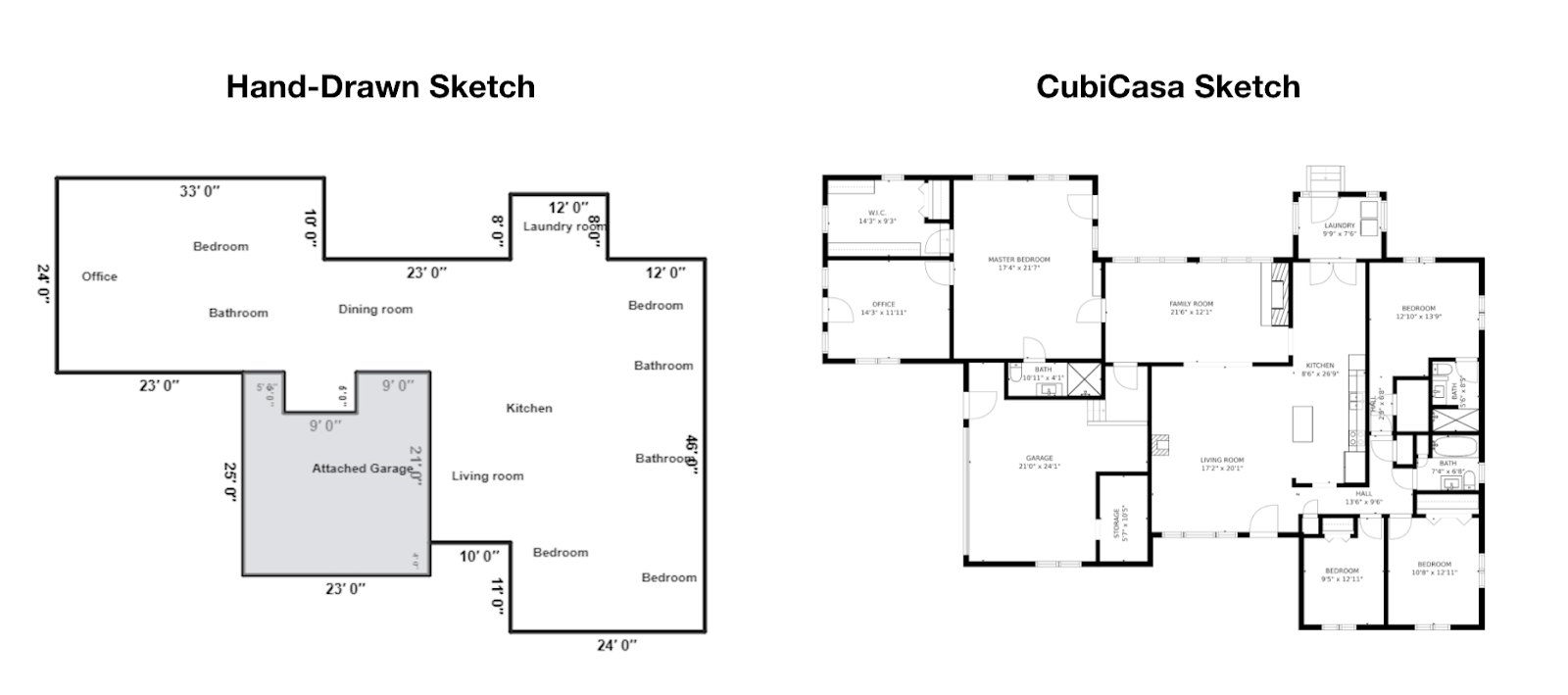

CubiCasa produces stunning sketches improving the collateral underwriting experience

Traditional hand-drawn sketches offer very little visual detail to the end-user. CubiCasa sketches are rich, detailed, and give a crystal clear sense of the property’s flow. The added detail is essential to understanding functional obsolescence, value-added features like walk-in closets, and more.

Take a look at the same property hand-sketched in the traditional method, compared to a CubiCasa floor plan.

What does automated floor plans and digital GLA technology unlock for our industry?

At a high-level, this kind of technology completely democratizes the single-hardest part of teaching non-appraisers to perform property data collection in appraisal modernization programs. The technology can also provide improved consistency, unified standards, and better underwriting usability over the traditional, hand-drawn process.

The implications of that innovation are massive and precisely what we’ll be digging into on our next blog post — the final in our three-part series.