Image by rawpixel.com on Freepik

With different quality standards skyrocketing in recent times, keeping pace with evolving expectations can prove challenging. That’s why we’ve enhanced our pre-check rules – the risk indicators you encounter upon uploading your report that address our most common correction requests!

Taking the time to make updates to your report before submission can effectively minimize the need for extensive revisions down the line, saving you valuable time.

3 benefits of pre-check rules

- Provides high-quality reports with reduced revisions which will save time so you can focus on current orders

- Taking action on these alerts prior to submission significantly reduces correction requests, boosts your quality scores, and expands access to future orders

- Proactively addressing alerts accelerates payment processing

Pre-check actions

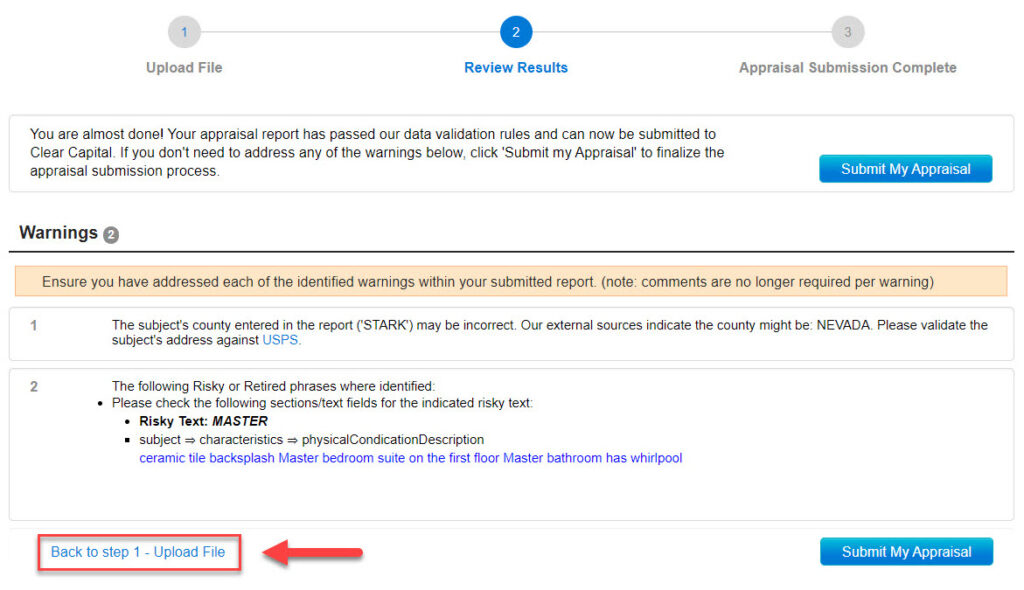

- During the submission process, read the pre-check rule alerts. These alerts are listed under “Warnings.”

- Use the “Back to step 1 – Upload File” link (shown below) to review the pre-check flagged items in the report.

- Make updates to correct and clarify as necessary and then re-submit the report.

We understand the challenge of revising a report once it’s signed and converted into a data file. However, proactively addressing these potential concerns before submission can significantly save time in the long run. Our upgraded quality pre-checks not only help in avoiding corrections but also enhance efficiency and effectiveness, instilling confidence by ensuring credibility for both borrowers and lenders alike.