Our suite of traditional and modern valuation products are designed to improve outcomes for consumers, lenders, and appraisers — backed by 20+ years of expertise and three layers of quality assurance.

Our appraisal solutions help lenders, underwriters, servicers, and borrowers save on costs and reduce manual efforts. For more than 20 years, we’ve equipped appraisers with powerful tools to improve appraisal quality on traditional and modern appraisals.

Our Traditional Appraisal solutions fit a variety of lending needs, from conventional loans, refinances, home equity lending, and more.

Obtain a reliable opinion of value for single-family purchase loans using a 1004 Desktop or 70D appraisal.

A bifurcated appraisal that is GSE-compliant and up to 50% faster than a traditional appraisal for purchase and refinance loans.

Access a full suite of modern valuation products that integrate with any order management or loan origination system.

Our appraisals undergo multiple layers of quality assurance — combining data analytics review, risk-based review, and review by our quality assurance teams.

Clear customer and appraiser communication will keep you updated throughout the process. Receive well-defined and easy-to-understand appraisal reports.

Clear Capital appraisals are compliant with USPAP, Fannie Mae, Freddie Mac, FHA, USDA, HUD, and VA guidelines as appropriate.

For more than 20 years, our appraisal solutions have helped appraisers, lenders, and other key stakeholders enhance operational efficiency and deliver better outcomes to homeowners, buyers, and sellers.

We provide industry-leading valuation technology that improves appraisal quality, quickens turnaround times, and increases consistency across the industry. Our modern appraisal programs are the result of years of building strong partnerships with lenders and investors, countless hours of research and tech development, and a dedication to pioneering the future of real estate valuations.

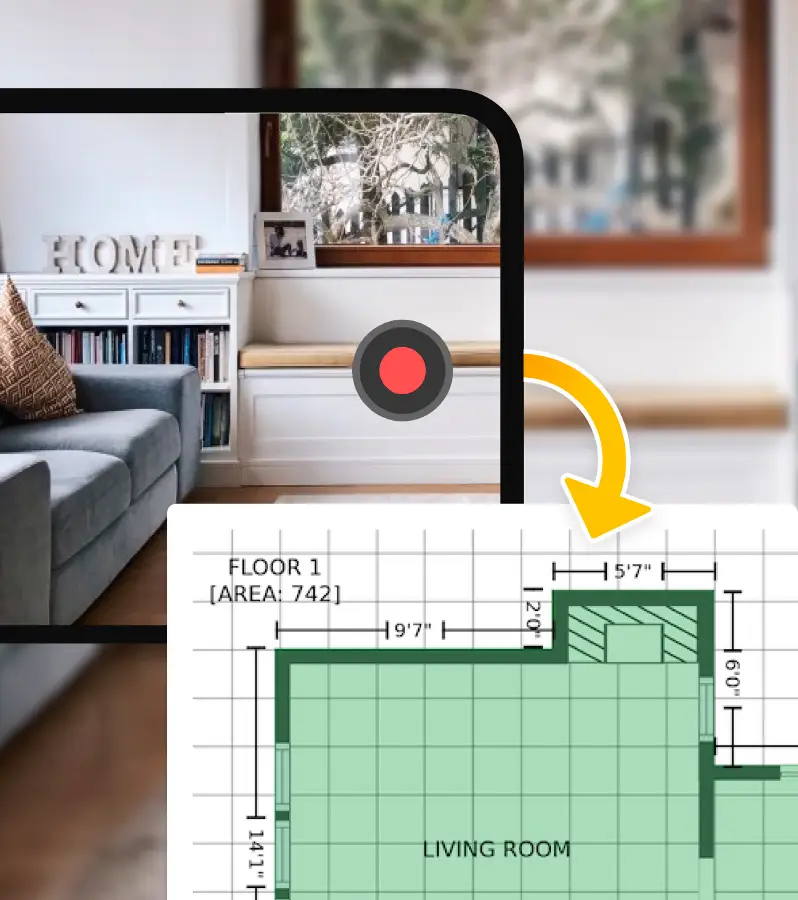

A property data collection service that supports appraisal modernization by enabling lenders to implement Fannie Mae’s Value Acceptance + Property Data program and Freddie Mac’s ACE+ PDR solution.

Our nationwide network of property data collectors and appraiser partners fuel our modern appraisal solutions by gathering data necessary for hybrid appraisals, desktop appraisals, and inspection-based appraisal waiver programs.

Clear Capital data collections

average turn time

Broker Price Opinion (BPO) is the ultimate alternative to an appraisal for servicing, origination, and investments.

IAG-compliant and well-suited for originating loans on transactions less than $400,000 — including HELOCs.

Get rapid condition updates on residential and commercial properties from experienced and trained professionals.

Discover how our traditional and modern valuation solutions can help save you time and money, improve outcomes for your customers, reduce manual efforts, and enhance operational efficiency.

We’ll keep you in the loop on the latest stories, events, and industry news.