A next-generation analytics tool with nationwide coverage that enables quick, comprehensive property value conclusions.

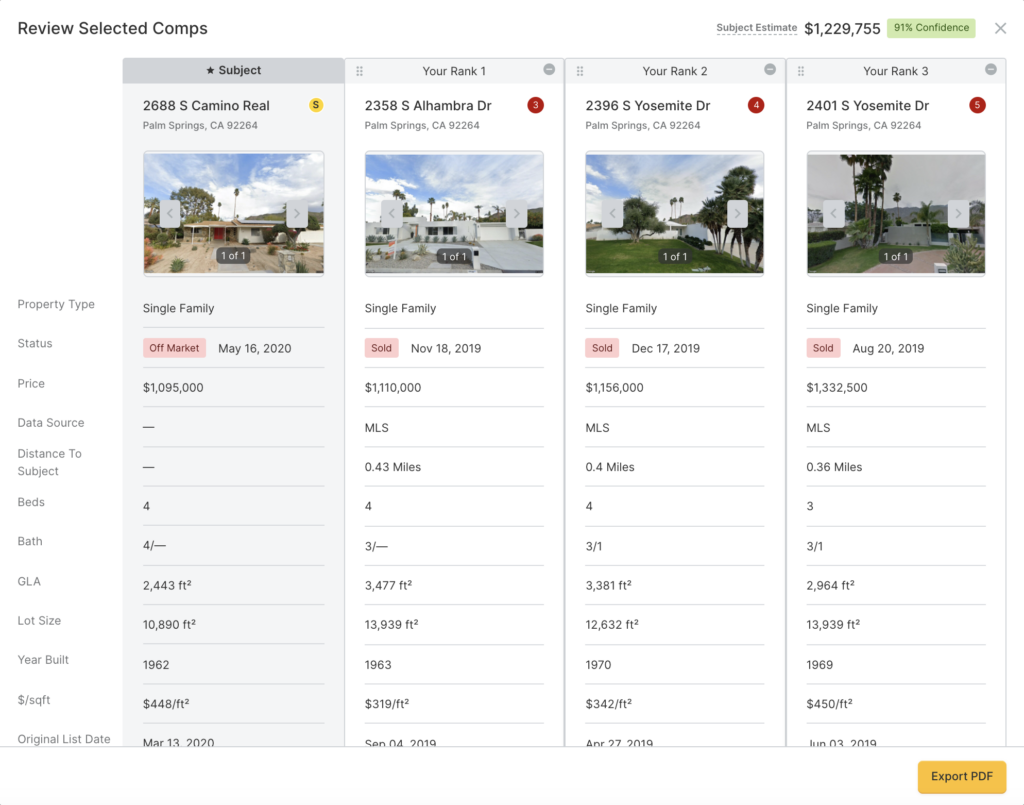

Interactive comp tool

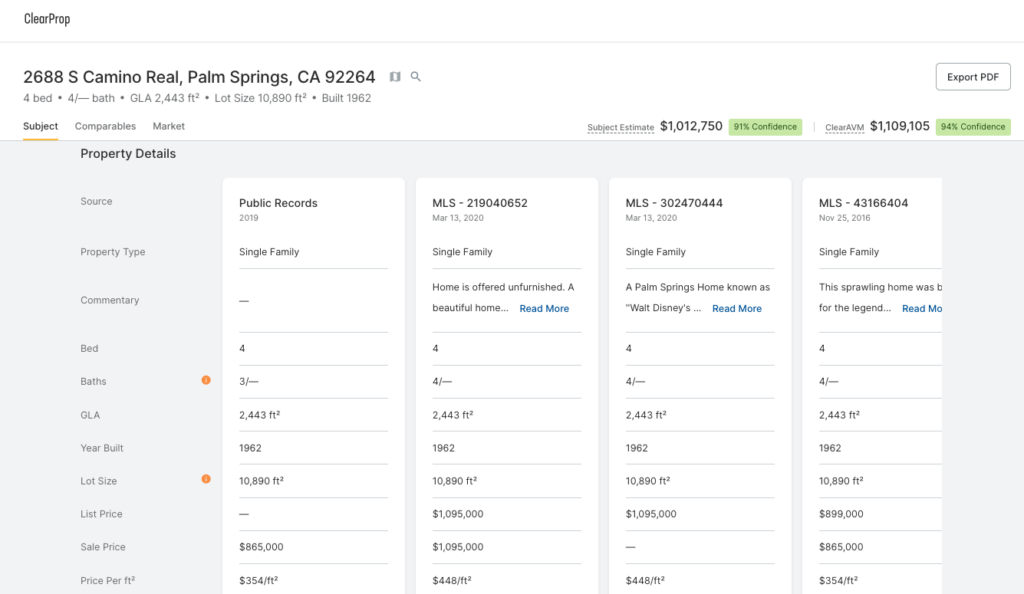

ClearProp lets you filter, select, and save comparables. Selecting individual comps provides an instant estimate of the subject’s value along with a confidence level — powered by ClearAVM’s valuation engine.

Compare a sale or listing side-by-side to the subject for a quick assessment.

Make adjustments to narrow your comp set — or adjust comp parameters to pull in a new set — that will allow you to quickly and easily create a better valuation.

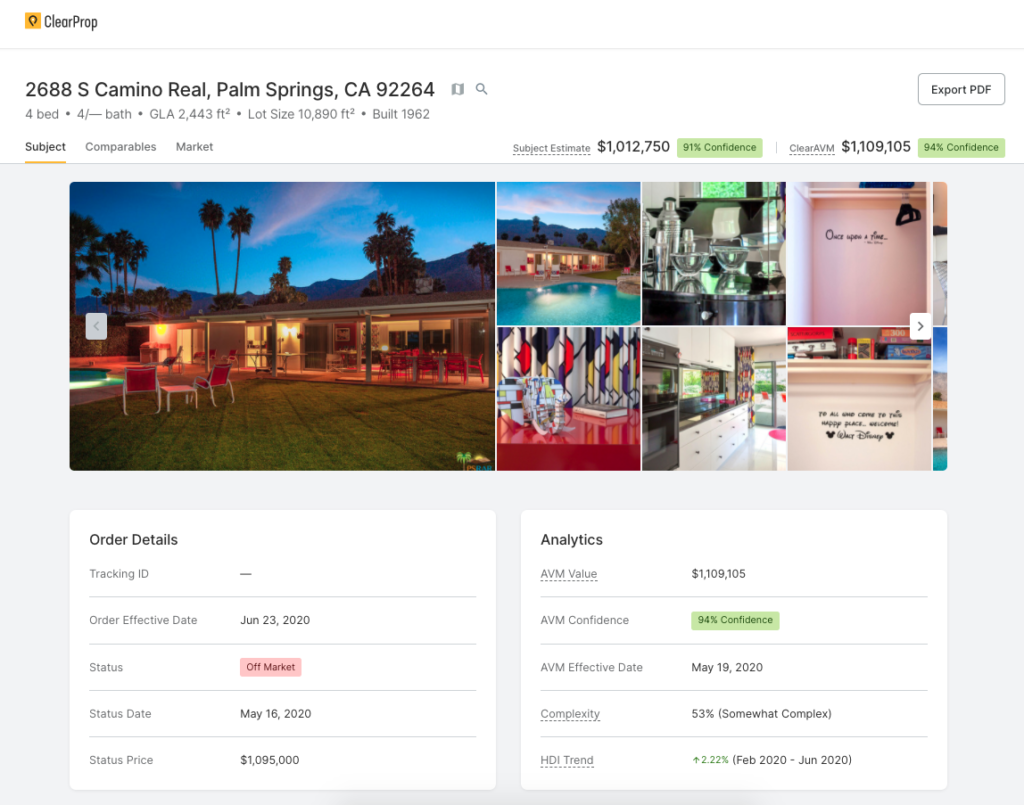

ClearProp unites data that is typically fragmented, making it a powerful research and verification tool. And while ClearProp is rich with data, it’s thoughtfully and meticulously organized.

ClearProp makes double-checking easy

property knowledge, complexity info, and market insights.

determined by the industry’s leading AVM and backed by hand-selected comps.

verification of an appraisal or bulk portfolio review.

ClearProp proprietary analytics is powered by advanced local market insights that are refreshed daily, so you can ensure your analyses are accurate and current.

Clear Capital has one of the highest-coverage, ethically sourced property information data sets in the country, with access to 93% of all listings in the U.S.

ClearRank compares thousands of comparable properties and ranks them by their similarity to the subject. See side-by-side characteristics, photos, and more.

Every ClearProp includes an incredibly accurate, lending-grade automated valuation model (AVM) powered by an advanced machine learning engine.

Dive into past listings, transactions, and tax values to obtain a more comprehensive view of a property’s history.

Historical price trends help you put current valuations into context. View forecasts that highlight the expected price trajectory over the next two quarters.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved