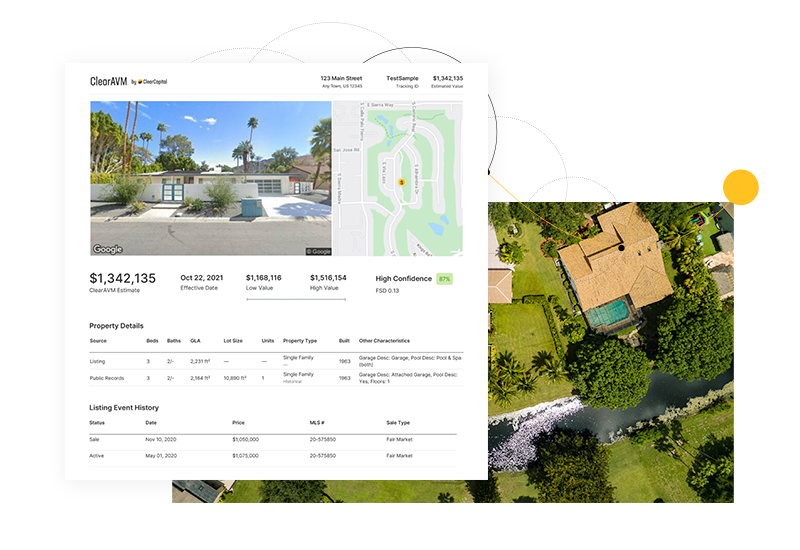

Get a valuation you can trust in seconds. ClearAVM is one of the highest rated lending-grade automated valuation models (AVM) on the market.

Accuracy

ClearAVM is tested against closed sale and refinance appraisal benchmarks, internally evaluated, and blind-tested by reputable third parties.

ClearAVM’s accuracy allows it to be relied on by investors, lenders, and regulators.

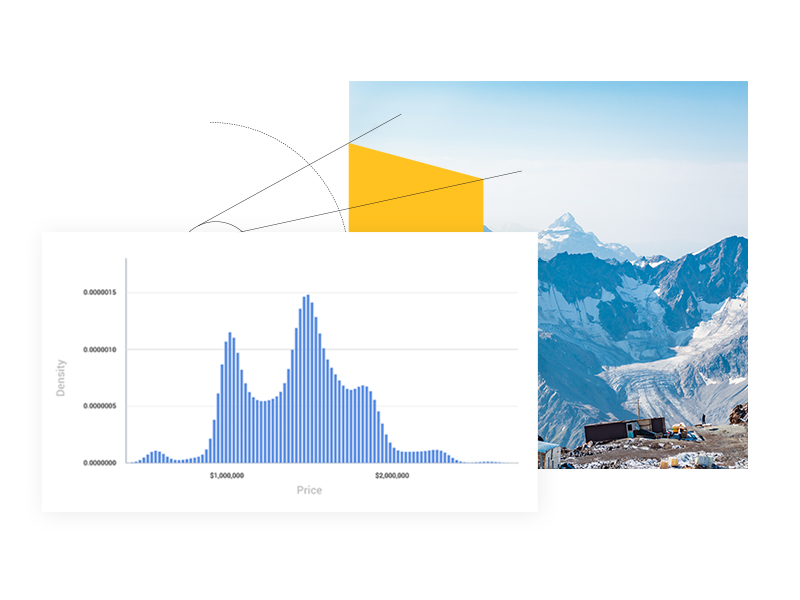

Data coverage

An AVM is only as good as its data. That’s why the data that powers ClearAVM — data on nearly every property in the nation — is updated hourly with information on nearly every address in the U.S., including non-disclosure states.

Valuations nationwide

Coverage of U.S. homes

Find lending opportunities

Accurately identify marketing targets by filtering properties across the nation for characteristics that fit your needs.

Estimate a prequalification

Build trust and avoid last minute changes by using the same quality valuation throughout your lending process.

Make lending decisions

Underwrite quickly and close with confidence by leveraging ClearAVM’s accurate valuations.

Invest confidently

Scan for investment opportunities and evaluate potential with reliable home values at scale.

Confirm a value

Ensure a portfolio of loans is priced correctly by instantly and accurately valuing the collateral.

Monitor performance

Evaluate your portfolio with the same level of accuracy used to underwrite and sell loans

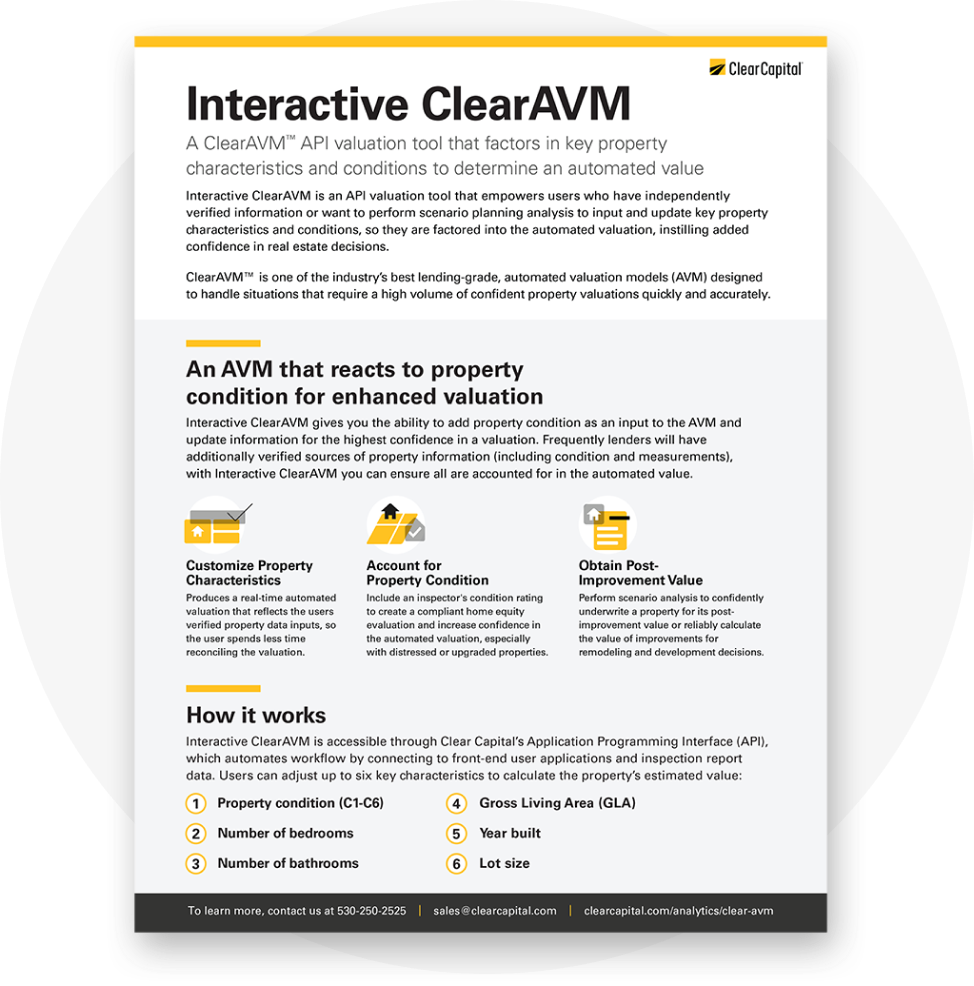

An AVM that reacts to property condition

If you know a home’s condition, shouldn’t your AVM reflect it? Interactive ClearAVM supplies characteristics such as home condition, square footage, and more to provide a valuation that reflects those characteristics in real-time.

See for yourself how accurate ClearAVM is — get five free AVMs!

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved