Clear Capital’s Commercial Evaluation is a simple and affordable solution for commercial properties and loans valued at less than $500,000.

Clear Capital’s Commercial Evaluation is perfect for securing loans valued at less than $500,000, valuing commercial properties to be used as collateral on business loans less than $1 million, and for extending credit and loan modifications.

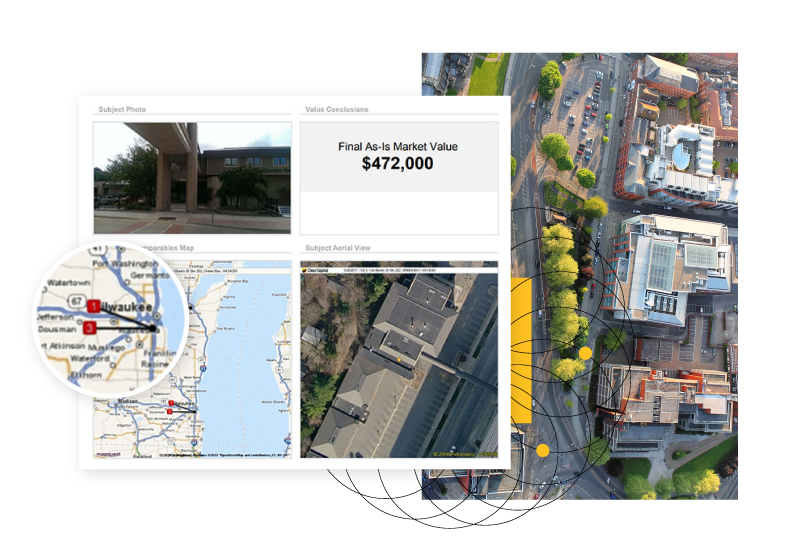

This data-rich report is accurate, easy to read, and fully compliant with state and Interagency Appraisal and Evaluation (IAG) Guidelines.

Why use a Clear Capital Commercial Evaluation?

Non-compliance wastes time and money. Clear Capital’s Commercial Evaluation is designed to be fully compliant with IAG Guidelines and regulations in all 50 states. To achieve this, the report format and all processes that support it adhere to each state’s specific requirements.

Our nationwide network of agent, broker, and appraiser partners are educated in commercial evaluation and experienced in the industry. Each valuation report is completed entirely by our network — from onsite inspections to data gathering, analysis, and value conclusions.

Enjoy a cost-effective alternative to appraisals for lower-value loans.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved