Our GSE-compliant 1004 Hybrid/70H Appraisal delivers a reliable opinion of value for home purchase and refinance loans nationwide.

Clear Capital’s

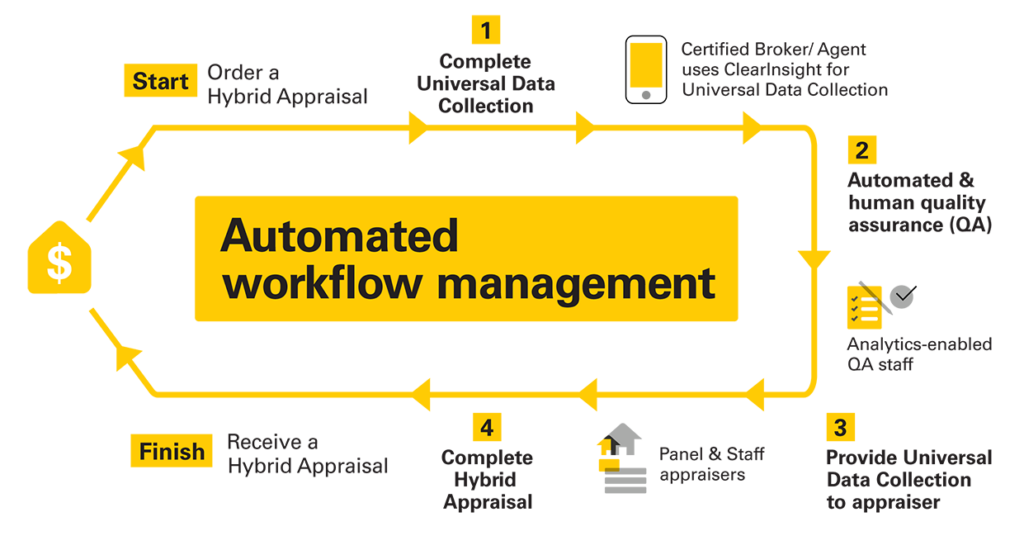

Our Hybrid Appraisals are powered by an integrated technology platform and centralized communication to keep the process simple and up to 50% faster than a traditional appraisal.

Agency approved and lender tested

Our program was co-developed with and designed for the agencies and top lenders.

Integrated technology platform

All property data, information, and photos flow efficiently through the process from start to finish.

Nationwide human networks

We will be your single point of contact to manage everyone involved and to ensure quality.

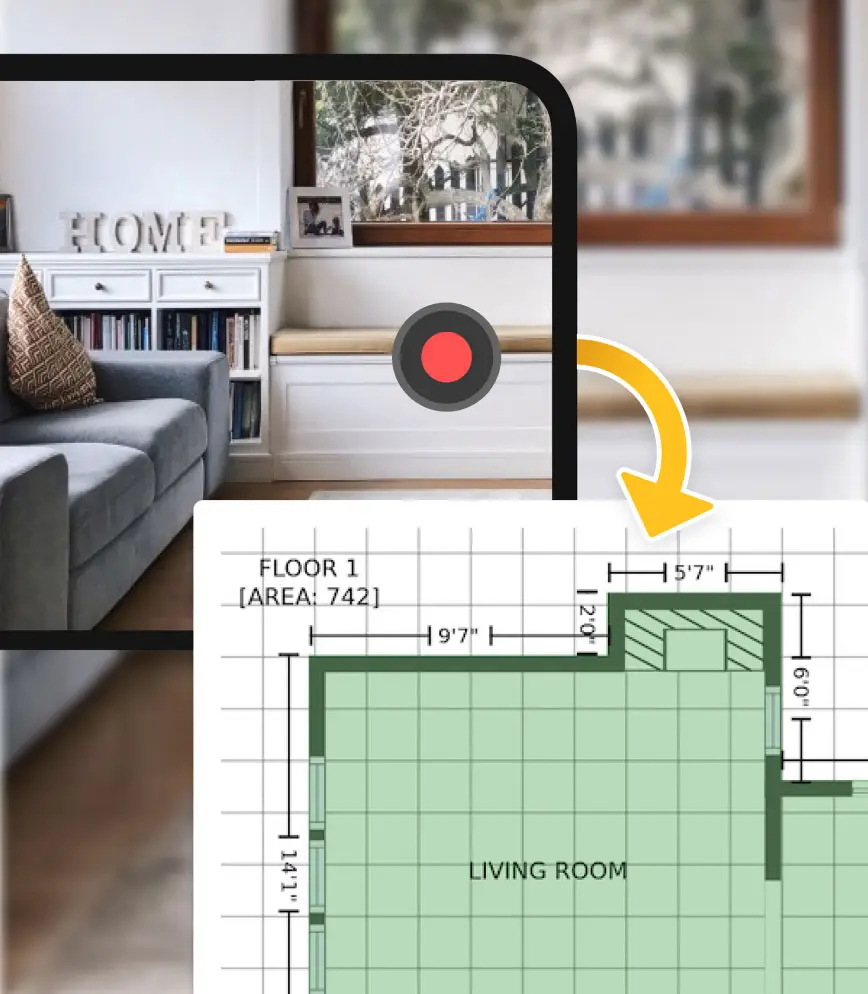

By arming our data collectors with ClearInsight to produce a Universal Data Collection™, our Hybrid Appraisal solution delivers consistent property data collection quality and completeness in real time.

Fast turn time

Up to 50% faster than a traditional appraisal. The process pairs certified brokers/agents conducting the property data collection with automated reviews to maintain quality.

Price certainty

With Hybrid Appraisal’s standard pricing, lenders and borrowers know the total cost of the appraisal when an order is placed. There’s never a fee escalation with standard pricing.*

Universal Data Collection

The data captured in the Universal Data Collection (UDC™) data set is provided to an appraiser to complete 1004 Hybrid/70H appraisals.

Trustworthy data

Our network of certified brokers and agents capture property information, photos, and floor plans to help appraisers complete a Hybrid Appraisal.

Accessible

Clear Capital’s extensive partner relationships and API integration prowess make integrating Hybrid Appraisals into your order management system easy.

Scalable

Quickly adopt and scale using our panel of brokers/agents, experienced appraisers, and quality assurance teams who specialize in modern appraisal solutions.

*Custom pricing models are available but may not include price certainty.

Save time and money with our nationwide Hybrid Appraisal. Learn more today.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved