Learn how our real estate valuation products can help with your mortgage loan portfolio assessment.

From traditional appraisals to alternative valuations, our products can help you assess your mortgage loan portfolio by:

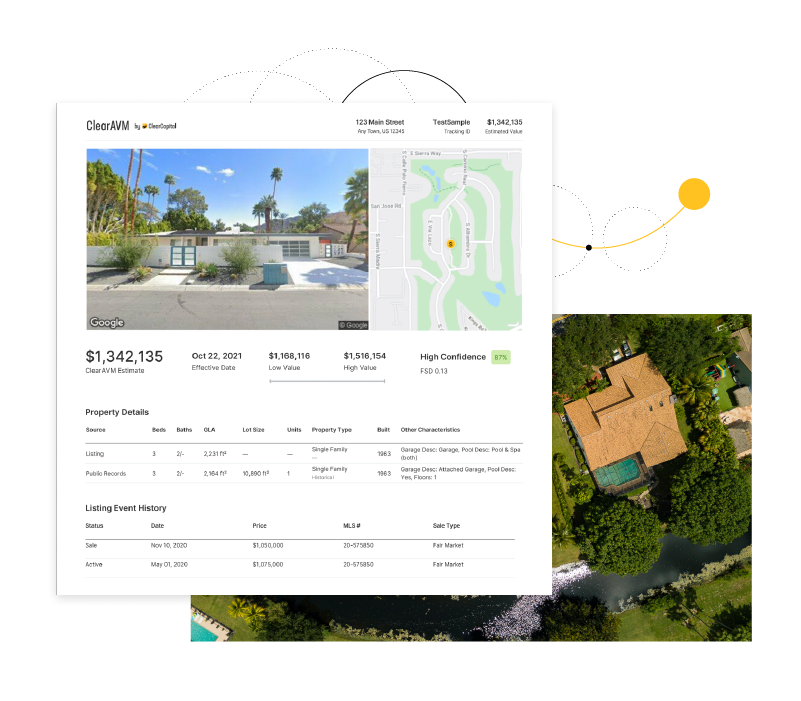

ClearAVM is one of the industry’s best lending-grade AVMs designed to handle a high volume of property valuations quickly and accurately.

ClearAVM can be combined with a boots-on-the-ground broker/agent external and/or internal property condition inspection (PCI) to understand the property’s condition.

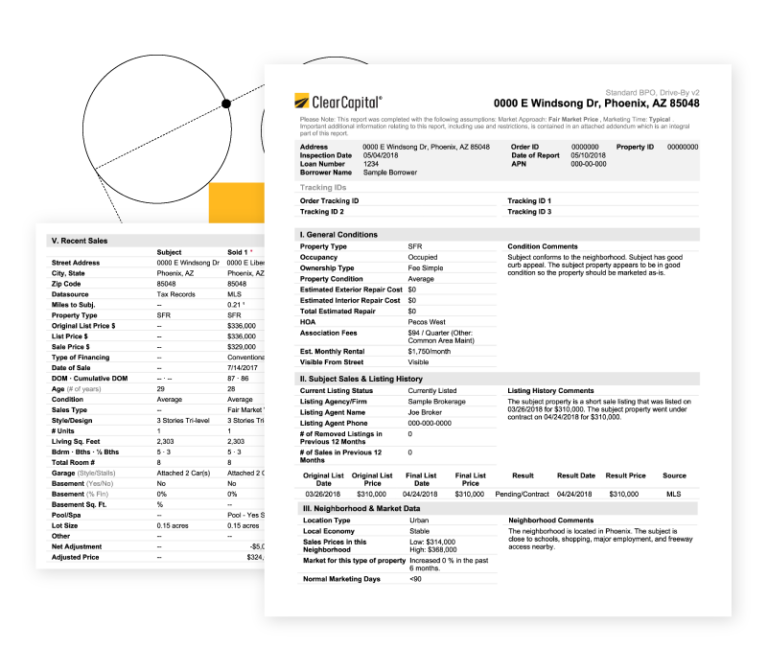

As Morningstar’s top-rated (MOR RV1) BPO, our BPO employs three layers of quality assurance so you receive a detailed valuation and local market insight without the full cost of an appraisal.

Check on your portfolio quickly and accurately, with turn times ranging from 1 – 5 days.

Completed by a licensed appraiser from Clear Capital’s national appraisal management company.

Order a traditional appraisal for foreclosure and other high-risk property valuation situations with a high estimated value or high complexity.

Learn how our suite of real estate valuation solutions for mortgage servicing can help you.

We’ll keep you in the loop on the latest stories, events, and industry news.

300 E 2nd St., Suite 1405

Reno, Nevada 89501

530-550-2500

© 2024 ClearCapital.com, Inc. All Rights Reserved